Nearly every mining company has a long-term net zero goal. Intense regulatory pressure on emissions means companies in all sectors need a net zero strategy. Most mining companies analysed by GlobalData have set 2050 as the target year for achieving net zero carbon emissions. In the interim (2025-2035), they will implement shorter-term emission reduction goals, typically aiming for around a 30% reduction by 2030.

Emissions in mining operations mainly come from direct activities (Scope 1) and the energy consumed (Scope 2) in extraction and transportation. Scope 3 emissions are significant, particularly where mined products like coal greatly contribute to greenhouse gas emissions during processing and use. Downstream Scope 3 emissions are generally much higher compared to the upstream side.

Mining companies are overall steering their emissions on a downward trajectory, but more effort is required to meet the 2050 targets.

Who is winning the race to net zero?

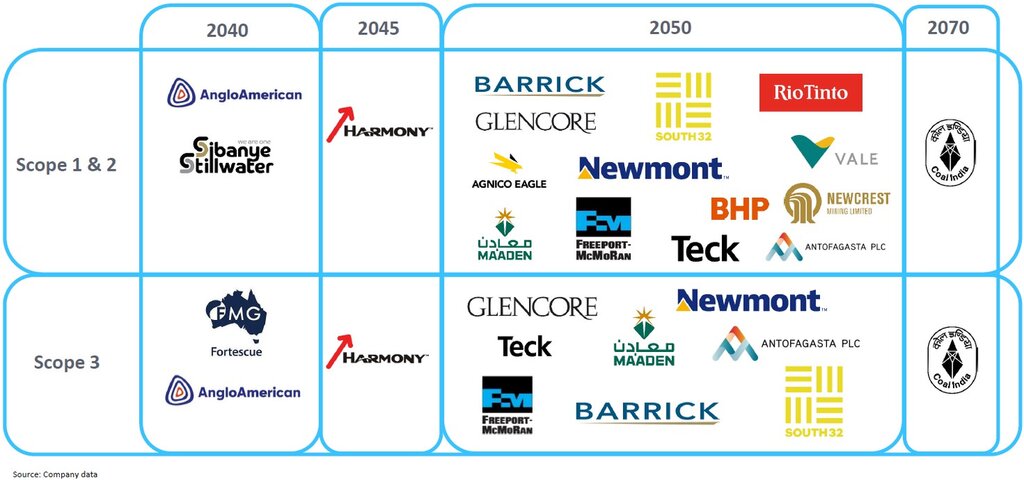

All mining majors have set net-zero targets for operational emissions, most of them for the year 2050.

Caption. Credit:

Emerging as leaders are companies that prioritize sustainability, adopt clean technologies, use renewable power sources, set ambitious and realistic emission reduction goals, and engage in transparent reporting (high CDP rating and SBTi approval).

Laggards, meanwhile, show limited commitment to climate action and provide opaque ESG reporting (low CDP rating and no SBTi approval).

ESG, especially its environmental component, will have a greater bearing on companies’ success and failure.

Caption. Credit:

Scope 1 and 2 emission reduction strategies

Scope 1 and 2, which are generated by business operations, make up around 40% of total emissions. The main contributors to direct emissions (Scope 1 & 2) include the use of heavy machinery, ore transportation, various on-site processes, and the purchase of electricity. Mining companies are investing heavily in renewable energy, with many setting short-term 100% renewable energy targets.

Shifting power sources is the main game in town. Increasing the share of renewable energy consumption is a primary way to achieve operational emissions reduction in the short term. This shift is facilitated through Power Purchase Agreements (PPAs) and, when grid power is unavailable where mining companies operate, directly through on-site power plants. Instead, diesel displacement in favor of mining vehicles powered by electric batteries or fuel cells is a medium-term emissions reduction strategy.

Renewable energy (short term)

Increasing the share of renewable energy consumption is a primary way to achieve emissions reduction. This shift is facilitated through PPAs where grid power is available. In Brazil, for instance, mining companies can benefit from high proportions of their grid-sourced power coming from renewable generation. For example, Vale sources almost 90% of its power from renewables.

When grid power is unavailable where mining companies operate, renewable energy can be sourced directly through on-site power plants.

For example, Rio Tinto is planning to invest between 30–40% of its $7.5bn capex investment in decarbonization to add 1GW of renewable power and associated transmission infrastructure in the Pilbara over the remainder of the decade.

Meanwhile,Antofagasta successfully reduced its operational emissions by 0.75 MtCO2e (a 38.2% GHG emissions reduction), primarily due to the shift of all its mining operations to using power from 100% renewable energy from April 2022.

Increasing the use of natural gas is a way to transition away from higher-emission fossil fuels such as coal, diesel, and heavy fuel oil.

Diesel displacement (medium term)

Diesel use in mobile fleets can contribute to more than 90% of Scope 1 emissions in surface mines. Diesel-fuelled mining vehicles are gradually being replaced by those powered by electric batteries or fuel cells. Various miners have begun to implement electric fleets or initiate trials, partnering with original equipment manufacturers (OEMs) and incentivizing cross-company initiatives.

First Quantum Minerals is also using trolley assist trucks at its Sentinel and Kansanshi mines in Zambia, while its Cobre Panama mine will eventually have the world’s largest fleet with 38 T 284 Liebherr trucks, according to the manufacturer.

Teck and Caterpillar announced an agreement in early 2022 whereby Caterpillar will supply Teck with 30 zero-emission large haul trucks, beginning at Teck’s Elk Valley operations in 2027.

Agnico Eagle (particularly from its acquisition of Kirkland Lake Gold), Vale, and LKAB are amongst the early adopters, with the highest share, as tracked by GlobalData, in Canada (39%).

Supply chain collaboration (medium to long term)

Mining companies work with downstream industries to jointly develop and implement emission reduction initiatives. They focus on optimization of transport methods to reduce the carbon footprint. They work to ensure the use of cleaner sources of energy and energy-efficient technologies by producers, suppliers, downstream customers, and smelters.

Scope 1 and 2 emissions are more immediate and controllable than Scope 3 emissions.

GlobalData’s thematic analysts discuss the current state of sustainability commitments in the power, oil & gas, and mining sectors, and how companies are working to reduce their environmental impact.

Scope 3 emission reduction strategies

Around 60% of emissions in the mining sector are value chain emissions, known as Scope 3. Scope 3 encompasses emissions up and down the value chain, starting from initial materials extracted to the final use of a product.

Very few mining companies have clear strategies for mitigating Scope 3 emissions, and only three companies of the 20 companies analysed are targeting Scope 3 emissions in the short term.

There is increased recognition of the importance of addressing Scope 3 emissions, given their prominence compared to Scope 1 and 2. This means that even if mining companies reduce GHG emissions from their operations, their sales are still at risk from the impact of net zero mandates on other sectors. Influencing factors include the type of minerals extracted, specific refining processes, regulatory framework, location, and ultimate use and disposal of the end product.

Downstream Scope 3 emissions are generally much higher compared to the upstream side and most of these arise from the processing of sold products and transportation and distribution.

Supply chain collaboration is key to reducing value chain emissions. Companies need to work with downstream industries to jointly develop and implement emission reduction initiatives such as the optimization of transport methods and the use of cleaner sources of energy and energy-efficient technologies.

The largest source of value chain emissions is the steelmaking process. Many mining companies heavily reliant on steel-making companies are focusing on blast furnace optimization, switching away from blast furnaces or adopting carbon capture.

Reducing Scope 3 emissions is challenging, and strategies can vary based on the circumstances of each company.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.