IN NUMBERS

How mining came to be Australia’s most profitable sector

Mining remains Australia’s single largest sector, and a bastion of stability and profitability amid the uncertain times of the Covid-19 pandemic. JP Casey investigates the statistics behind the industry’s recent meteoric rise to see how it has secured such a position of dominance and stability.

M

ining remains the top dog in the Australian economy. New figures from the Australian Bureau of Statistics (ABS) show that the sector was responsible for more than one-tenth of the economy between 2019 and 2020. Meanwhile, resources and energy exports reached a staggering $221.2bn in value over the same period, establishing Australian mining as both a massive component of both its domestic and international economies.

This growth has brought with it an array of benefits, from mining providing some of the most stable and reliable jobs in Australia to the fact that technological innovations are often proven in mines and refineries. Equally, there remain questions about the sector’s long-term financial and environmental viability, with mining emissions continuing to spiral at home and coal demand drying up overseas.

Yet despite these challenges, the Covd-19 pandemic, which has been the greatest challenge of all for a number of industries around the world, has not troubled Australian mining. So entrenched is the sector in the country’s culture and economy, even a year-long pandemic has struggled to dislodge it from the heart of Australia.

With these internal successes and external pressures at odds, we look at the statistics to see what made Australian mining what it is today.

Mining is Australia’s single largest sector

The most striking statistic is that mining remains Australia’s largest sector by share of total national GDP, with the ABS reporting that the industry was responsible for 10.4% of national GDP between 2019 and 2020.

Much of this is tied to the inherent resiliency of the mining sector amid the pandemic; mining’s isolated working environments were less affected by lockdown measures, for example.

In addition, expansive exploration work prior to the pandemic highlighted a number of new mineral deposits, such as the Beta Hunt gold mine in Western Australia, which added around $11.5m in value in just four days. This has helped to ensure confidence in the long-term finances of the sector.

Mining remains a rare positive for the Australian economy

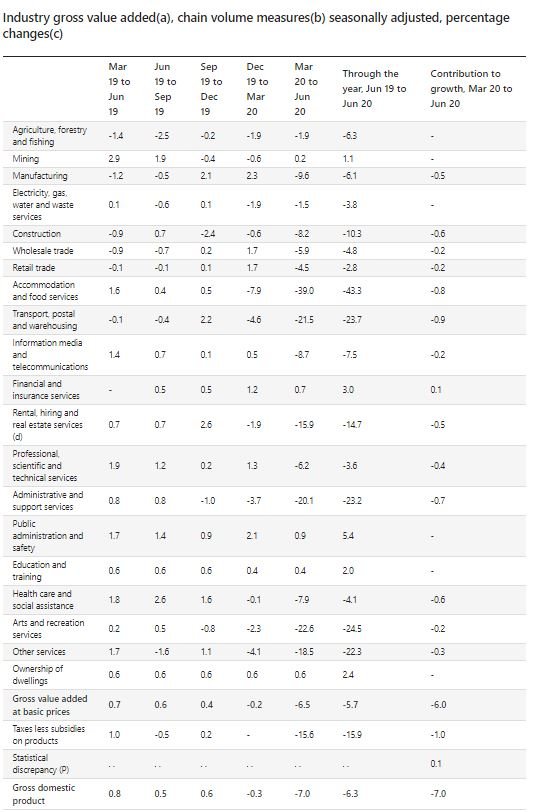

This strong financial performance led to mining contributing 0.1% of Australia’s GDP in 2020, and was one of only four sectors to record a positive contribution, alongside financial services, public administration, and safety and education and training. Much of this positive contribution was driven by the fact that Australia’s mines kept producing, while other sectors struggled to keep up.

Between June 2019 and June 2020, the total output of Australia’s mining industry increased by 1.1%. This is compared to, for instance, a 10.3% fall in construction output, a 23.2% drop in administration, and a 43.4% decline in the accommodation and food services sector.

Credit: Australian Bureau of Statstics

Australian exports continue to flourish

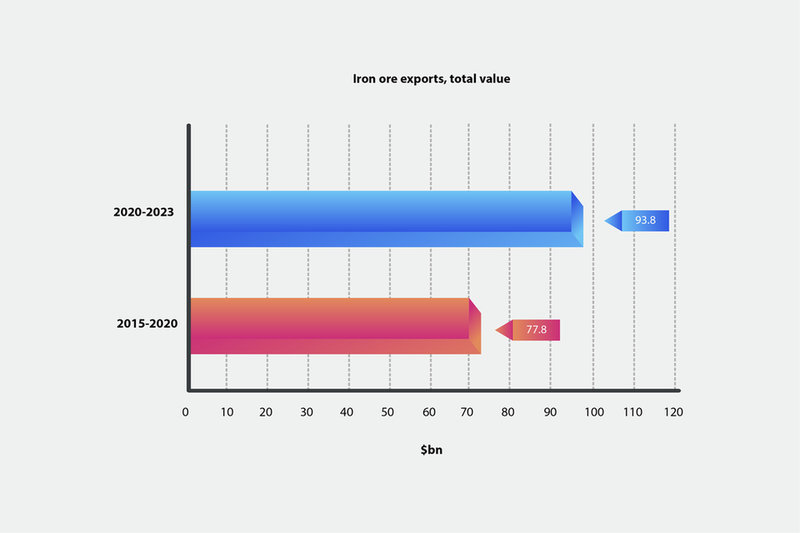

Despite concerns about the impacts of the pandemic on international trade, Australian mining exports have grown both in quantity and value.

China’s appetite for iron ore in particular remains unaffected by the pandemic – it was the world’s biggest importer of iron ore, responsible for 68% of overseas acquisitions between 2019 and 2020.

With the pandemic affecting a key iron exporter, Brazil, Australia has emerged as the new go-to source for iron ore. Australia became the world’s largest iron ore exporter over the last two years, responsible for more than half of all iron ore exports, a trend that is expected to drive the total value of iron ore exports up from $77.8bn in 2019-20 to a massive $93.8bn in 2020-21.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Data Credit: Australian Bureau of Statistics.

Financial rules bend in mining’s favour

On the one hand, the uncertainty surrounding the long-term impacts of the pandemic has made some investors hesitant to back large-scale mining projects. But on the other, such is mining’s importance to the Australian economy that many financial rules are being shifted to protect investment, particularly from foreign backers.

For instance, the government announced in March 2020 that all foreign mining investments would require government approval to go ahead, but dramatically expanded the timeframe to review applications from 30 days to six months, making large-scale investments more feasible. This translated to a 3.9% increase in investments in machinery in Queensland due to, according to the government, “increased mining investment”.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Mining remains a cornerstone of Australian employment

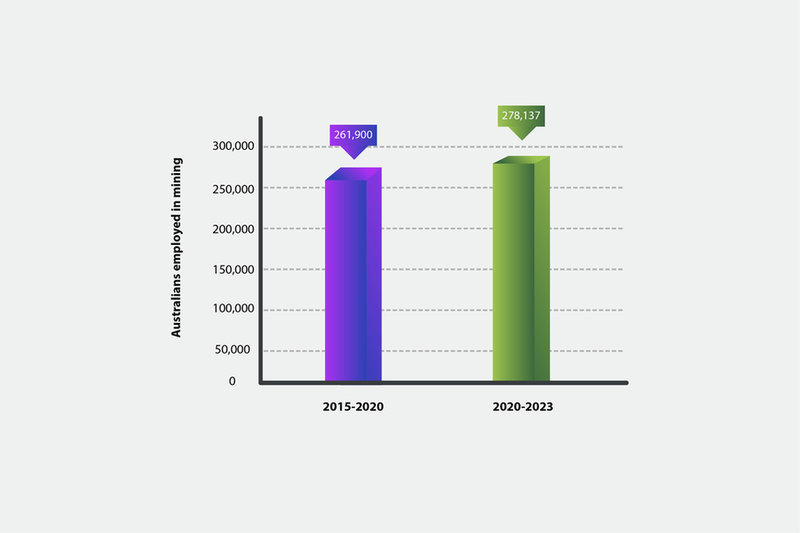

A combination of the resiliency of mining and a recent push for additional hires in the mining industry means that the total number of Australians employed in the sector has actually increased in recent years.

Government figures reveal that the number of Australians employed in mining increased by 21.4% in the five years to 2020, to a total figure of 261,900.

The government also expects this figure to increase by 6.2% over the next three years, with mining so deeply embedded in both the Australian economy and culture that the workforce is not expected to shrink any time soon.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Data Credit: Australian Bureau of Statistics.

Technological innovation continues to advance mining

Australian mining has received significant support from a number of scientific organisations and technological innovators.

The Commonwealth Scientific and Industrial Research Organisation has backed a number of projects, such as a $4.6m laboratory to develop 3D printing and metal additive technologies for sectors including mining, and a remote worker tracking network for use in underground mines.

This is an example of the virtuous cycle of Australian mining, where the industry is so profitable and so ingrained in the country’s economy that it receives significant attention and investment from the scientific community, leading to further advances in the mining sector.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Coal could struggle in the long-term

Despite many of the positive steps made by Australian mining, the mineral fuels sector struggled in 2020. Government figures show that there was a 0.7% decrease in both coal mining and oil and gas output, leading to declines of 8.3% and 1.7% in the exports of coal and other mineral fuels respectively.

Much of this is tied to a broader turn away from fossil fuels, that began long before the pandemic and is likely to continue after, but has not been helped by controversies such as the ongoing protests against the Bravus Carmichael coal mine in the country.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Environmental challenges remain

In addition to the economic challenges facing coal and other fossil fuels, there is an obvious environmental cost to Australia’s significant investment in these forms of power.

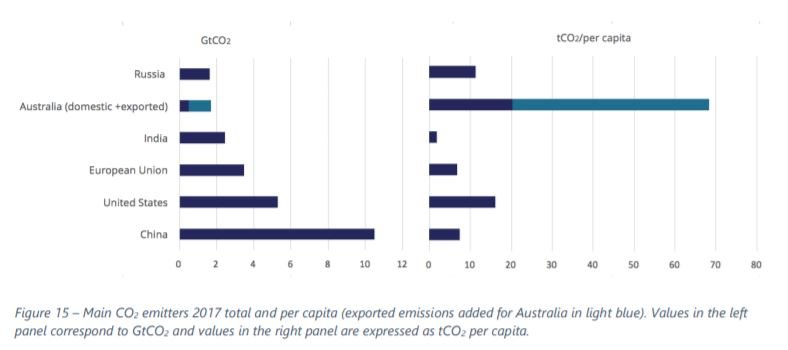

A report from Climate Analytics found that Australia was responsible for just 1.4% of global carbon dioxide emissions in 2017, but that this figure jumped to 5% if considering Australian exports in addition to domestic usage.

Indeed, Australia’s per capita emissions, including exports, are four times that of the US, nine times that of China, and 37 times that of India, making Australia one of the most significant emitters on a per capita basis.

Considering that much of the Australian economy is tied up in such emission-heavy industries, untangling the financial benefits from the environmental damage remains a key challenge for the country.

// Main image: 3D System Model and Completed Installation. Credit: Deimos

Credit: Climate Analytics