Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 17 February

After weeks of gradual decline, GDP estimates for many countries have levelled off.

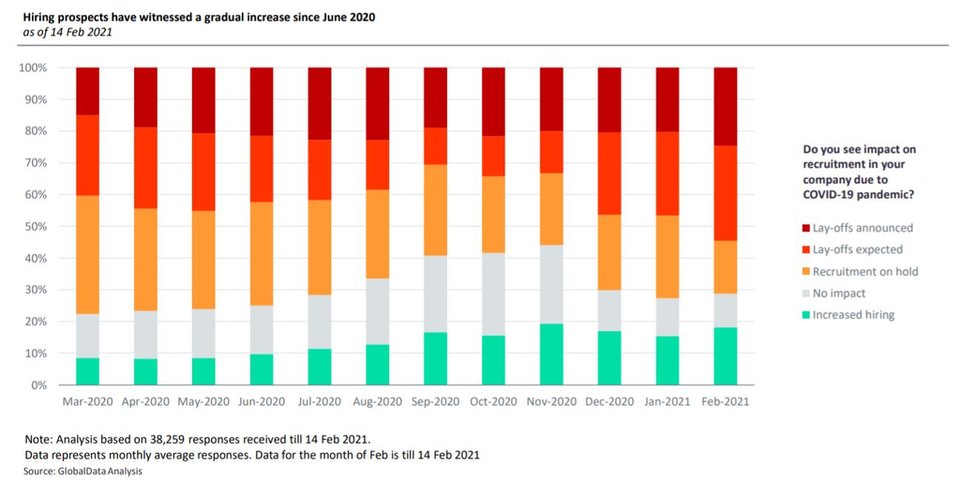

Polls show that employment prospects have consistently improved since July.

4.8%

The Japanese economy expanded by 3% (YoY) in Q4 2020, however economic growth for the full year shrank by 4.8%.

4.4%

The Conference Board forecasts the economic growth rate of the US at 2% (annualised rate) in Q1 2021 and at 4.4% and 3.1% for 2021 and 2022.

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 3 March

commodity impact

43%

Lower automotive manufacturing hit the price of platinum and palladium, which are used in autocatalysts. Palladium prices dropped 43% between 28 February and 16 March but recovered to pre-Covid levels helped by the lockdown in South Africa impacting supply.

39%

Platinum prices fell 39% from 1 January to 19 March 2020, but, with rising demand for retail platinum jewellery, reached $1,078/troy oz on 31 December and passed $1,300/troy oz in February 2021 before dropping back.

value chain impact (short term)

Much prospecting and exploration has been deferred due to financial consolidation by mining companies.

Construction activities were slowed down by lockdowns, whilst some investment decisions have stalled pending market improvements.

Large numbers of mines were temporarily closed in several markets, except where considered an essential service. Interruptions to supply chains will affect production.

Demand for many commodities, such as base metals and PGMs has dropped significantly with the slowdown of the global economy.

Key commodity developments