DEALS ANALYSIS

Deals activity: North America leads in deal value; gold continues sector growth

Powered by

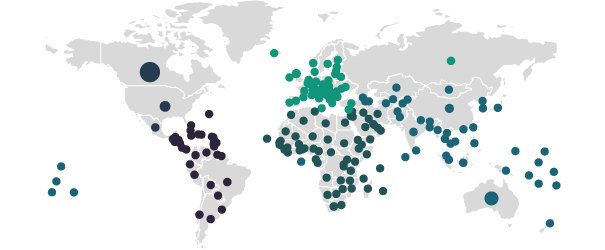

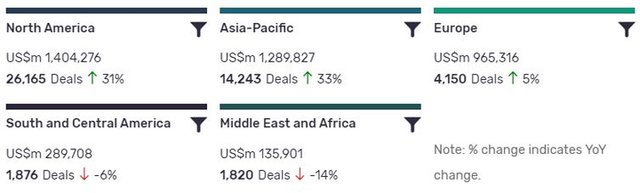

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are largely up year-on-year (YoY) across all regions.

North America is leading in terms of deal value ($1,404,276m), but its 31% YoY growth has been bested by Asia-Pacific (33%). Europe has also managed to maintain positive growth, with an increase of 5%.

However, the volume of deals recorded by GlobalData decreased YoY in Middle East and Africa and South and Central America, with the former seeing a decline of 14% and the latter one of 6%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 450451 | 23300 | 16 |

| Asset Transaction | 526500 | 10420 | -30 |

| Acquisition | 2055752 | 8979 | 17 |

| Debt Offering | 796225 | 2469 | -13 |

| Partnership | 3417 | 1377 | -74 |

| Private Equity | 61049 | 646 | 117 |

| Venture Financing | 1370 | 221 | -72 |

| Merger | 52539 | 207 | -64 |

A breakdown of deals by type and volume shows a general downtrend, with mergers down -64% YoY, partnerships down -74%, and asset transactions down -30%. One bright spot was acquisitions, which grew 17%. Financing deals have seen less of a downturn; while venture financing down -72% YoY and debt offerings down -13%, equity offerings are up 16% and private equity has seen surprisingly good growth, with a 117% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the continued strength of gold's growth. Beyond that, having ended last year very close in totals, other commodities are extending a stronger lead over silver than may have been expected. Uranium meanwhile, remains the smallest sector by number of deals.

Note: All numbers as of 08 March 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

Battery metals firm DeepGreen signs deal to merge with SOAC

Canadian battery metals firm DeepGreen Metals has agreed to merge with special purpose acquisition company Sustainable Opportunities Acquisition (SOAC) to go public. The deal values the combined company at $2.9bn and includes a private investment in public equity of $330m, priced at $10 per share.

Equinox Gold signs deal to increase stake in Hardrock Mine Project

Equinox Gold has agreed to acquire an additional 10% stake in the Hardrock Mine Project in Canada from an affiliate of Orion Mine Finance Group, for at least $51m. The deal will increase the Canadian gold miner’s stake in the Hardrock Mine Project to 60%.

Anglo Pacific signs $205m deal to acquire cobalt stream in Canada

Anglo Pacific Group has finalised an agreement to acquire a cobalt mine in Canada in an all-cash deal valued at $205m. Anglo Pacific will acquire a holding company that owns a 70% stake in cobalt streams from the mine at Voisey Bay in Labrador.

Silver Mountain Mines to merge with exploration company Nevgold

Silver Mountain Mines has signed a binding definitive merger agreement with Nevgold to create a new diversified exploration and development company. The deal follows the signing of a Letter of Intent between Silver Mountain Mines and Nevgold in January.

Brazilian development bank BNDES sells 3.6% stake in Vale

BNDES has sold its 3.6% stake in miner Vale, as the Brazilian development bank seeks to exit its position in several firms as a part of the wider government divestment strategy. In selling 188.5 million shares, the bank raised around $2bn.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.