DATA

Mining capital expenditure to rise by 12% across leading miners in 2023

In 2023, miners are expected to continue prioritising investment in critical minerals and decarbonisation efforts, according to GlobalData analysis.

Powered by

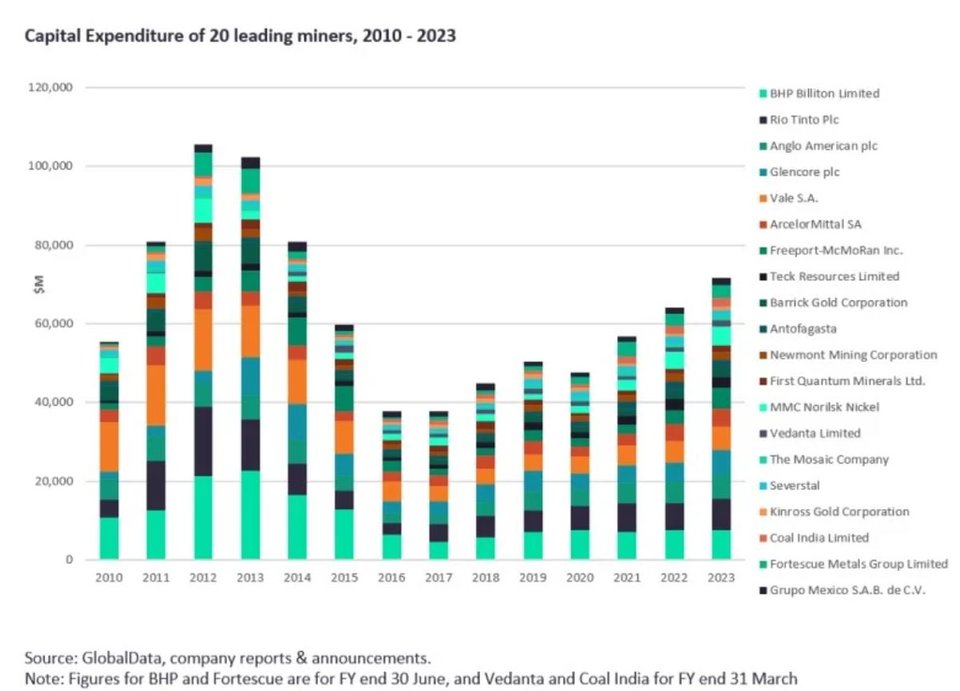

The latest guidance on capital expenditure for the current financial year from GlobalData points to another double-digit increase in mining capital expenditure amongst leading miners. After rising by 19% in 2021, the capital expenditure of 20 leading miners was initially expected to increase by more than 20% in 2022. However, due to factors such as delays, favourable foreign exchange rates and deferrals, the increase was lower, at 12.8%.

In 2023, across the leading 20 companies tracked, a similar rise is expected at 11.6%, with collective capital expenditure of $71.6bn, with miners continuing to prioritise investment in critical minerals as well as decarbonisation efforts.

The highest spender is expected to be Rio Tinto, whose latest guidance of $8bn includes growth capital of around $2bn, which may vary depending on the ramp-up spend at its Simandou iron ore mine. This is a 17.6% increase on the 2022 figure of $6.8bn, with further increases in 2024 and 2025, where between $9bn and $10bn is planned.

BHP’s capital expenditure in the last financial year, ending June 2022, was $6.1bn, and this is expected to rise to $7.6bn in its 2023 financial year and to $9bn in 2024. Some $860m of the 2023 financial year capex is being channelled to the Jansen Potash project, which is due to commence production in late 2026, while the company expects capital expenditure on operational decarbonisation to be around $4bn in aggregate until the 2030 financial year.

Anglo American’s 2022 capital expenditure reached $5.7bn in 2022, down from a previous guidance of $6.1bn to $6.6bn. This included spending of $500m on the Woodsmith polyhalite fertiliser mine as well as the Collahuasi desalination plant and start-up of Quellaveco copper mine in Peru, which began commercial production in September 2022. Guidance for 2023 is $6.0bn to $6.5bn, of which $0.8bn is planned for Woodsmith. The company also recently announced higher spending on the Woodsmith mine and a longer timeframe than originally expected, with production to commence in 2027.

Across the remaining miners Vale’s capital expenditure rose by 8% to $5.4bn in 2022, and the company expects to invest $6bn in 2023. Major projects include the Onça Puma second furnace and VBME construction, capital contribution for the Morowali project in Indonesia and Serra Sul 120 Mtpy and Capanema projects. Thereafter the company is expecting capital expenditures of $6.0bn to $6.5bn from 2024 to 2027.

Glencore is also expecting a similar spend of $6.0bn in 2023, up from $4.8bn in 2022. Spending is then expected to decline marginally to $5.7bn in 2024 and $5bn in 2025. Over the coming years, investments include the Collahuasi desalination, Raglan Phase 2 commissioning in 2024 and Onaping Depth commissioning in 2025.

A significant increase in capex occurred at Freeport-McMoRan in 2022, where spend rose from $2.1bn in 2021 to $3.5bn in 2022, of which $800m was for the Indonesian smelter projects. A further increase of $1.7bn is expected in 2023 as overall expenditure rises to $5.2bn, of which $1.8bn is required for the Indonesia smelter projects. This is expected to drop back to $3.6bn in 2024 with the smelter projects accounting for $0.6bn.

MMC Norilsk Nickel is planning a 10% increase in capital expenditure to $4.7bn, while guidance is for relatively flat spending at Barrick Gold of $2.2bn to $2.6bn after $2.4bn in 2022; and First Quantum is expecting a 28% increase to $1.6bn, due to an acceleration of spending at the Kansanshi project as well as inflationary pressures.