DEALS ANALYSIS

Deals activity: North America leads in deal value and growth; other commodities widen lead on silver

Powered by

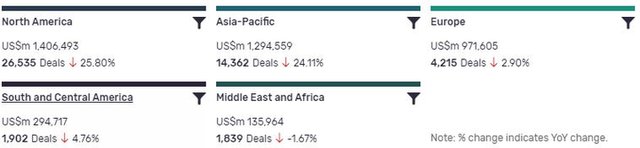

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are up year-on-year (YoY) across most regions.

North America is leading in terms of deal value ($1,406,493m) and YoY growth (25.8%). Asia-Pacific, Europe, and South and Central America also managed to maintain positive growth, with respective increases of 24.11%, 2.9%, and 4.76%.

The volume of deals recorded by GlobalData decreased YoY however in the Middle East and Africa, seeing a decline of -1.67%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 460027 | 23591 | 27.53 |

| Asset Transaction | 528791 | 10596 | -3.48 |

| Acquisition | 2064308 | 9105 | 38.49 |

| Debt Offering | 809990 | 2503 | -19.18 |

| Partnership | 3477 | 1391 | -73.17 |

| Private Equity | 63810 | 663 | 60.63 |

| Venture Financing | 1376 | 228 | -72.21 |

| Merger | 52541 | 212 | -96.71 |

A breakdown of deals by type and volume shows a general downtrend, while acquisitions are up 38.49% YoY, mergers are down -96.71%, partnerships down -73.17%, and asset transactions down -3.48%. Financing deals have seen a similar downturn, with venture financing down -72.21% YoY and debt offerings down -19.18%, although equity offerings are up 27.53%. Private equity has seen good growth, with a 60.63% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the continuing strength of gold. All other sectors have retained their relative rankings by volume from the year before, though other commodities have risen above silver and continue to widen their lead. In 2020, other commodities saw 1,395 deals, while silver saw 1,401. Other commodites have so far in 2021 accrued 367 deals, while silver has seen 290.

Note: All numbers as of 18 May 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

Major Drilling to purchase Australia’s McKay Drilling for $62m

Major Drilling Group has agreed to acquire Australian speciality drilling contractor McKay Drilling for $62m (A$80m). The acquisition marks the strategic entry for Major Drilling into the Australian mining and exploration sector.

Rio Tinto invests $21m to acquire minority stake in Canadian mine

Rio Tinto Canada is investing approximately $21.1m (C$25.6m) to purchase an 8% stake in Western Copper and Gold.

Appian to sell royalty interest in Chile’s Caserones mine for $23m

Appian Capital Advisory signed an agreement to sell its royalty interest in the Caserones copper mine to Nomad Royalty.

Coeur Mining acquires $117.2m stake in Victoria Gold

Coeur Mining has acquired a 17.8% stake in Canada-based Victoria Gold from Orion Co-VI for $117.2m (C$146.1m).

Corvus Gold secures $20m loan to fund North Bullfrog project in US

Corvus Gold has received a $20m loan from its shareholder AngloGold Ashanti to fund the development of the North Bullfrog project in Nevada, US.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.