REGIONAL FOCUS

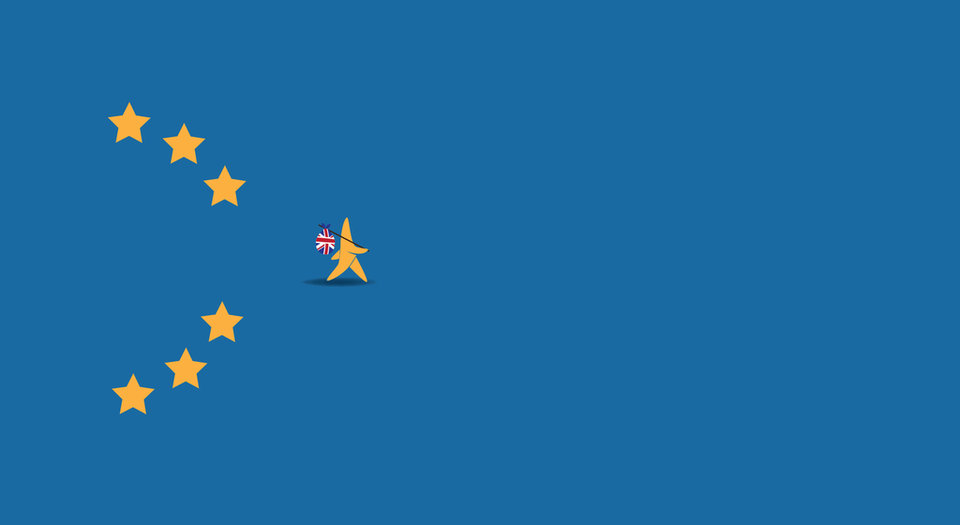

Brexit: how will the transition affect UK mining?

Brexit will bring with it the potential to set up new trade deals for the import and export of raw materials, providing the opportunity to shore up the UK’s mineral supply chain. JP Casey asks: can the UK overcome the significant challenges to reach a state of mineral independence?

T

he UK’s decision to leave the European Union is one that has been characterised by a mixture of confusion and trepidation, optimism and uncertainty. Brexit is a unique example of a country withdrawing from an international organisation on this scale, so there is little precedent for what could happen to both Britain and the EU in the long-term. This has led to rampant speculation as to the impacts of the momentous referendum held in 2016.

Figures produced by the UK Government in 2018 reported that the country’s GDP would fall by 6.7% compared to expected figures had Brexit never happened, but those same analysts predicted that trade with non-EU countries would increase by 5%, helping to make up some of this shortfall.

Indeed, with many of the motivations behind leaving the EU tied up in liberating British industries from pan-European regulation and oversight, there is a theory that Brexit will encourage Britain to produce more goods domestically, reducing its reliance on foreign imports.

While the UK is not a major mining power, many of these ideas impact the country’s mining industry. As a global trading centre, and the headquarters of many of the world’s international miners, the economic climate of the UK can have a profound impact on the mining companies based within its borders.

Similarly, with so-called “resource nationalism” encouraging domestic investment in mines, the UK could be set to invest in new mining operations and infrastructure across the country, helping to revive a long-dormant industry. Yet with post-Brexit economic uncertainty, and a lack of mineral wealth in the UK to begin with, challenges remain for the UK as it moves towards mineral independence.

British production and international pressure

Supporters of Brexit have argued that the severing of trade ties to Europe will encourage the UK to invest more heavily in British-based projects across a number of sectors, and the mining industry is no exception.

“Brexit, along with the UK’s industrial policy focus on ‘clean growth’, may help to boost the mining of critical minerals such as lithium, cobalt, graphite, and rare earth metals,” explains Sameer Chakravarthy, a mining expert at data analytics firm GlobalData. “Expected policy boosts from government will help in reviving the decades long declining mining industry post-Brexit.”

Projects such as Cornish Lithium’s proposed mine in the south-west of the UK, which aims to tap into “globally significant” reserves of the mineral, are the poster children of these new mining projects and they come at a time where new mining investment is at its most essential.

Lithium was recently added to a list of minerals considered critical by, ironically, the EU. The world is looking to wrestle control of the global lithium industry from China, whose companies control nearly half of the world’s reserves and dominate its production.

Expected policy boosts from government will help in reviving the decades long declining mining industry post-Brexit.

The threat of China with regard to lithium is emblematic of intensifying resource nationalism around the world, where the growing demand for minerals means that imbalances between countries’ access to particular minerals translates to imbalances in political power.

To use lithium as an example again, demand for the mineral is set to increase ten-fold over the next decade due to its vital role in electric vehicles. The Chinese lithium industry is expected to be worth up to $23.2bn by 2024, a vast driver of the Chinese economy that countries such as the US fear could underscore a tipping of global power towards China.

“With no strategic mineral policy in place from the government, securing the critical and rare earth minerals supplies might be challenging in the near to medium term for the British industrial firms,” notes Chakravarthy. “With the dominance of the rare earth mineral supply chain by China, there is still a lot of apprehension surrounding the rare earth minerals future supplies to critical defence and green energy projects.”

New mines and new facilities

West Cumbria Mining’s proposed coal mine is perhaps the perfect example of this union of domestic economic potential and external political pressure encouraging a new UK mining project.

The facility, which will produce 2.7 million tonnes of coking coal a year for use in the manufacture of steel, will look to address a significant imbalance in the UK’s steel industry, where British imports of steel from abroad have leaped by 74% between the start of 2009 and the end of 2016.

Critically, in May 2017, the International Trade Administration at the US Department of Commerce reported that while British trade volume had increased year-on-year by 5%, the value of these imports fell by 10%. This imbalance is creating an unsustainable trading dynamic where the UK is increasingly reliant on foreign steel imports, yet is receiving an increasingly worse deal for these agreements.

With even these unprofitable trade relations now hampered by Brexit, it is perhaps no coincidence that the UK Government has approved the country’s first new coal mine in 30 years.

Brexit and [the] subsequent economic uncertainties may help in finding better deals for critical minerals.

“A positive takeaway is there are no tariffs and quotas on all trade in goods originating in the EU or the UK,” says Chakravarthy, highlighting the potential for new, more beneficial trade agreements to come from the current vacuum of trade deals in the post-Brexit world. “Brexit and [the] subsequent economic uncertainties may help in finding better deals for critical minerals with many of the EU nations.”

In a similar vein, British miner Pensana Rare Earths is advancing with its plans to develop a rare earth processing plant in Yorkshire, a $125m facility that will be Europe’s only rare earth oxide separation facility.

By targeting both raw mineral acquisition and subsequent processes of processing and production, there is optimism that the UK will be able to develop a more coherent and financially viable mineral supply chain on its own terms, despite the relative lack of mineral wealth in the country.

Few minerals, less certainty

Yet despite these intentions, there is a fundamental challenge to the idea of Britain achieving a sense of mineral independence in the way that the US is aiming to: there are simply not enough mineral reserves in the UK, or even among its traditional trading partners, to support such a policy.

“With less known critical mineral resources available in the EU nations, the UK has to go for better trade negotiations with commonwealth nations, [such as a] few critical African nations, Canada, and Australia,” says Chakravarthy. “On the other hand, the UK may struggle on the ethical and greenhouse emission issues to close a deal with China, which has a poor record of the same.”

The idea of economic and political self-determination that has underpinned the Brexit movement is admirable, but the realities of the UK’s geology mean that such ideals may translate poorly to the country’s mining sector.

A 2019 report from the UK’s Parliamentary Office of Science and Technology concluded that “opening new mines, including in the UK, and expanding existing mines provides extra sources of raw material, but supply issues could still be encountered at later stages of the value chain”.

The supply chain costs are expected to go up significantly for the mining industry.

There is another key challenge in delivering mineral security post-Brexit, and that is the rampant uncertainty associated with the movement in general. The unprecedented nature of the UK’s departure from the EU, and years of ineffective negotiations between the bodies, means there is little understanding of how the UK’s economy will be specifically affected by the transition.

According to Chakravarthy, this is likely to lead to additional administrative delays and higher costs in international trade agreements.

“As per the trade agreement reached between the UK and EU, from 1 January 2021, all the exports and imports between the EU member countries and UK are subjected to customs formalities in the form of filing declarations for entry and exit of the goods,” Chakravarthy explains.

“At an average cost of $54.60 to $68.25 per declaration, the costs of importing and exporting vehicle parts, special equipment, mined ores, and finished mined products will go up significantly depending on the volumes. Additionally, goods are subjected to VAT and Excise Duties depending on the duties levied by the importing nation.

“Overall, the supply chain costs are expected to go up significantly for the mining industry.”

// Main image: 3D System Model and Completed Installation. Credit: Deimos