Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 17 February

While current consensus forecast for global GDP remains negative, many countries are seeing their own GDP level off after weeks of decline.

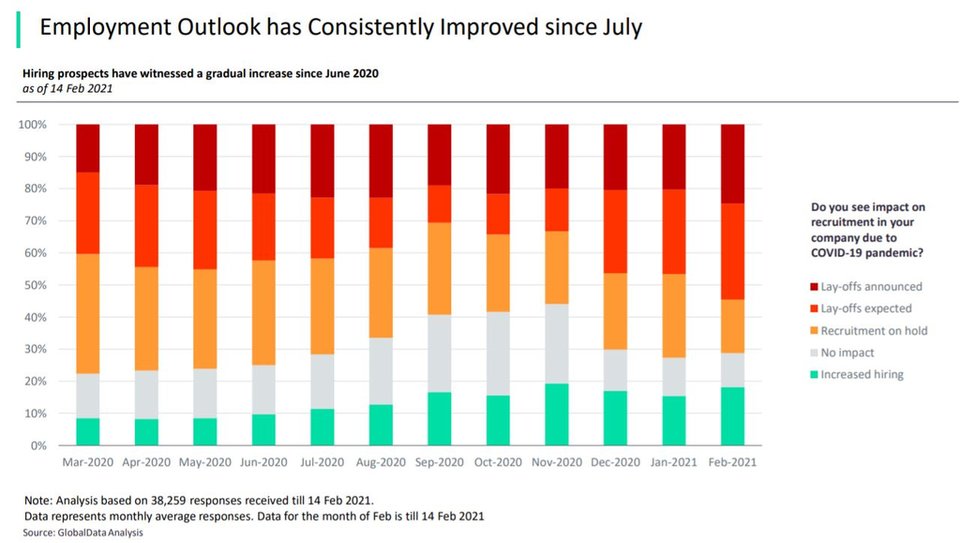

Polls show that employment prospects have consistently improved since July, with most employees favouring working remotely full-time.

4.8%

The Japanese economy expanded by 3% (YoY) in Q4 2020, however economic growth for the full year shrunk by 4.8%.

4.4%

The Conference Board forecasts the economic growth rate of the US at at 4.4% and 3.1% for 2021 and 2022, respectively.

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 3 February

demand side impact

4.5%

GlobalData expects that global construction output will expand by 4.5% in 2021, following the estimated contraction of 2.9% recorded in 2020. Global construction output excluding China is estimated to have shrunk by 5.3% and is projected to grow by 3.6% in 2021.

7%

The slowdown in construction led to an estimated 2% decline in copper demand and 2.8% drop in iron ore demand, while coal demand fell by an estimated 4.8%. Demand for platinum was estimated to have fallen by 7%, with a significant decline in production in the auto sector driving down demand.

Supply side impacts

Suspensions of mining were enforced in a range of markets during

late Q1 and early Q2 as governments looked to contain the spread of

the coronavirus. As of mid-April, some 1,542 mines were on hold, but

this had come down to less than 50 by the end of 2020.

Production was down for most commodities. Copper output was

estimated to have dropped by 2.6% and iron ore production by 2.5%,

with the impact in the latter primarily in Brazil. Recoveries are

expected in 2021, with mined copper production to rise by 5.6% and

iron ore by 4.7%.

Coal production was estimated to have fallen by over 5% in 2020 and,

while it will recover, with a forecast growth of 6.6% in 2021,

production is still expected at below 2019 levels.

Key commodity developments