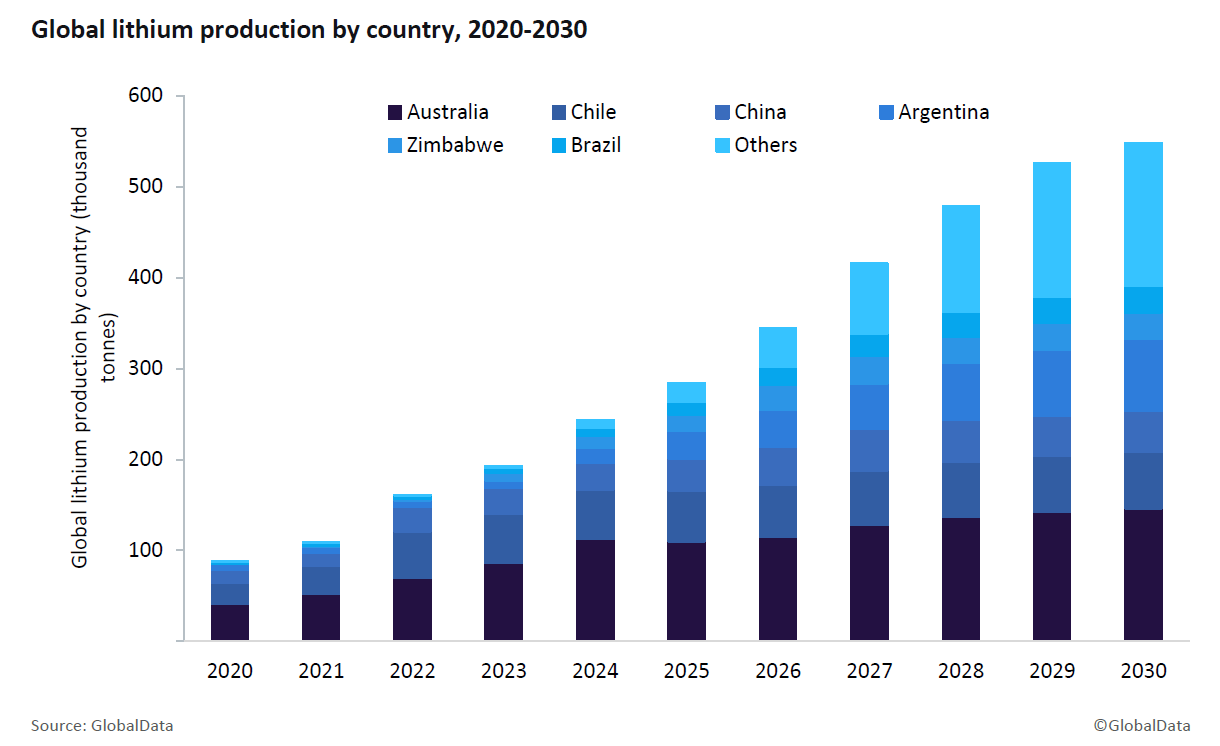

Despite falling prices amidst concerns over oversupply with slower EV sales growth, global lithium production is estimated to have grown by 26% in 2024, driven by both established and emerging producers.

While Australia maintains its position as the largest producer, countries such as Argentina, Zimbabwe, Brazil and Canada are significantly increasing their output. Combined output from these countries is expected to increase from 109.8 kilotonnes (kt) in 2023 to 156.4kt in 2024 – a 42.4% increase.

In Australia, production is estimated to have increased by 30.7% to 112.5kt in 2024, supported by the commencement of the Kathleen Valley and Mt Holland lithium projects. Chile, the world’s second-largest producer, is expected to see a modest 1.3% increase in production to 54.4kt, primarily driven by SQM’s Salar de Atacama mine.

Argentina’s production is estimated to have increased by 92.5% to 16.6kt due to the start of POSCO Argentina’s Sal De Oro Phase I. Zimbabwe and Brazil have also experienced significant growth, supported by new projects initiated in 2023. Brazil’s production is estimated to have increased by 86.2% to 8.8kt, driven by the ramp-up of the Grota do Cirilo Phase I project.

The global lithium market has traditionally been dominated by Chile and Australia, however, their shares will decline due to rising output from Argentina, Canada, and the US. In addition, Mali, with the start of the Goulamina lithium project in 2024, will be a key player in Africa.

Caption. Credit:

Global lithium production is expected to grow at a CAGR of 14.5% to over 548.5kt by 2030. Argentina, Canada, Australia, and the US will be key drivers of this growth. Several projects are expected to come online in the coming years, including 3Q, Sal De Oro Phase II, and Hombre Muerto West in 2025; Sal de Vida and Pozuelos-Pastos Grandes in 2026; and Laguna Verde and Kachi Lithium Brine in 2027.

Production cuts, delays and reassessment

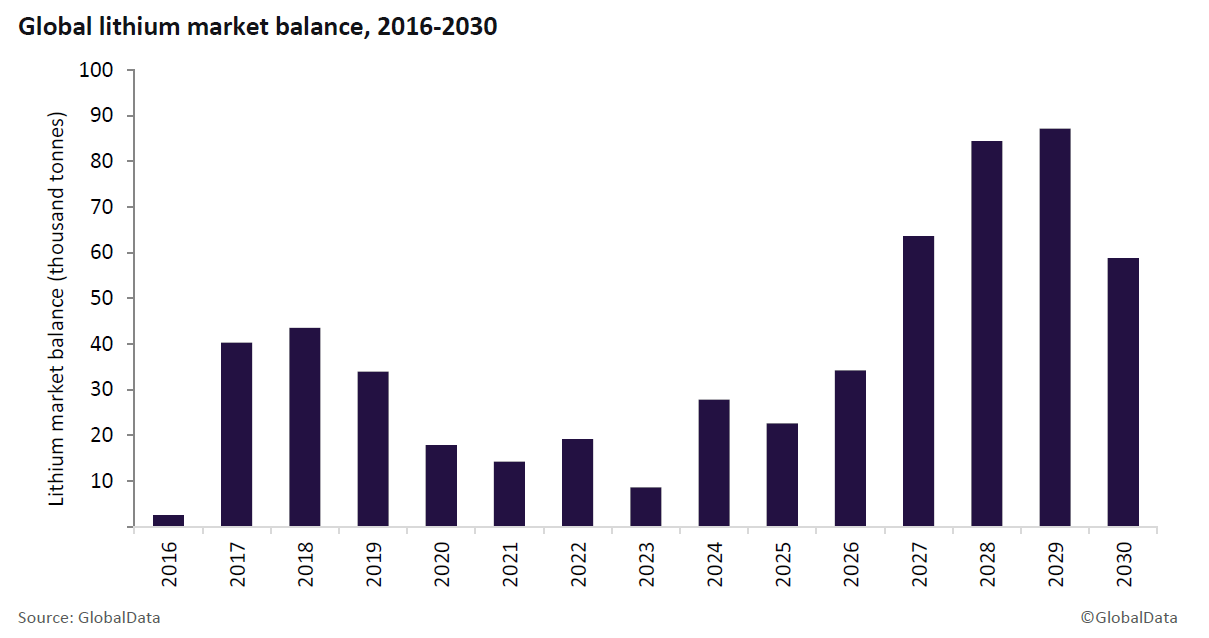

Lithium prices experienced a significant downturn in 2023 and 2024, primarily driven by a combination of increased supply and weaker-than-expected EV demand. This price decline has had a substantial impact on the lithium mining industry, leading to production cuts, project delays, and a reassessment of investment strategies.

Several major mining companies, particularly in Australia, were directly affected. Mineral Resources suspended production at its Bald Hill lithium mine, while Liontown Resources lowered its production targets from three million tonnes (mt) to 2.8mt and delayed its timeline for achieving this from the first quarter of 2025 to the end of the 2027 fiscal year. Core Lithium also temporarily halted mining operations at its Finniss project.

Furthermore, in late January this year, a catastrophic fire at the Mount Holland lithium mine in Western Australia underscored the inherent risks and operational challenges within the industry.

To mitigate the impact of falling prices, companies such as Piedmont Lithium implemented workforce reductions and cost-cutting measures. Overall, the decline in lithium prices increased scrutiny from investors, leading to delays or cancellations of several projects, particularly those with higher production costs or more challenging operating environments.

The EV market experienced substantial growth in 2023, with global sales reaching a record 24.7 million units. While the overall trend remains positive, growth has slowed in some markets like China and Europe due to factors like subsidy reductions, economic uncertainties, and policy changes. Despite these challenges, the long-term outlook for the EV market remains optimistic, with global sales projected to surpass 60 million units by 2030.

Caption. Credit: