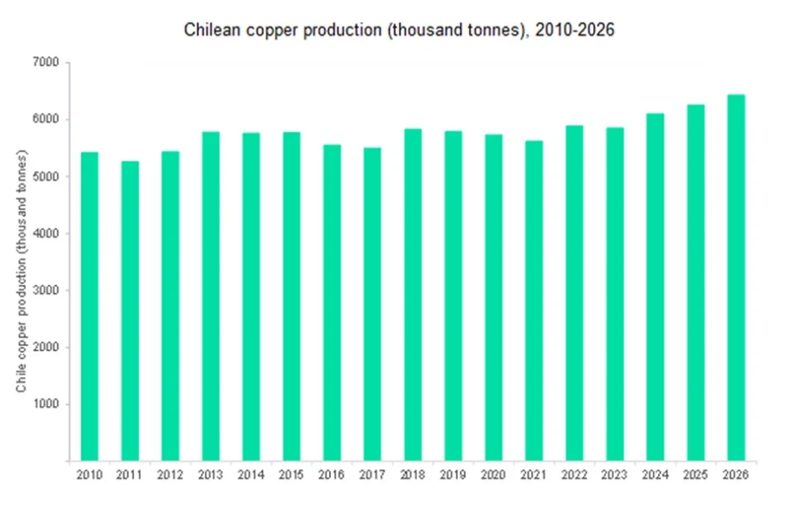

Chile’s copper production to recover by 4.7% in 2022, after a 1.9% decline in 2021

Production from Los Pelambres declined by 9.7% to reach 324.7kt of copper in 2021, due to lower throughput.

Chilean copper mine production declined for the third consecutive year, to 5,624.9 thousand tonnes (kt) in 2021 – down by a marginal 1.9% over the previous year. This was mostly due to lower production from the country’s largest copper-producing mines, including Escondida, Spence, El Teniente and Los Pelambres.

Production at BHP’s Escondida and Spence mines was affected due to a decline in the concentrator feed grade at Escondida, as well as planned lower ore stacking grade at Spence. The former mine is the largest copper producing mine in the country, accounting for 14% of total copper production in 2021.

However, BHP has raised its copper projection for the Escondida mine for FY2022 (July to June) from 1,000kt–1,080kt to 1,020kt–1,080kt, citing an expected improvement in concentrator feed grade during the first half of 2022, as a result of planned mine sequencing.

Production from another major mine, Antofagasta's Los Pelambres, declined by 9.7% between 2020 and 2021 to reach 324.7kt of copper due to lower throughput.

While the county’s copper output fell by 7% year-on-year in January 2022 – the highest annualised rate of decline since August 2021, and the lowest January output since 2012 – production is expected to recover over the remainder of the year with 4.7% annual growth to reach 5,890.7kt.

This will be helped by production ramp-up from the start of new mines including, Esperanza Sur Pit, Quebrada Blanca Phase 2 and the Los Pelambres expansion project.

Chilean copper production is expected to grow at a CAGR of 2.2% over the forecast period (2022–2026), to reach 6,432.1kt by 2026, with the commencement of new projects. Over 29 projects are expected to commence operations during the period, of which 11 are under construction, and are expected to add more than 1,100.7kt of copper production capacity.

The Quebrada Blanca Phase 2, Esperanza Sur Pit, Andes Norte, Los Pelambres Expansion and Santo Domingo projects are some of the major development projects. However, the Chilean Government’s new royalty bill, introduced in 2022, will levy a 1% tax on gross sales for projects producing less than 200kt copper per year and between 1% and 3% for others, increasing the tax burden on miners and potentially leading to a reassessment of investments.

// Main image: Horne Foundry at dusk. Credit: LarryDallaire / Shutterstock.com

COMMENT