Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 14 April

After months of decline, GDP estimates for many countries have turned positive.

Polls show that concern over the spread of Covid-19 remains volatile, so does business optimism.

6.5%

The Spanish Government downgraded its economic growth forecast for 2021 to 6.5% from its earlier projection of 7.2%

9.6%

According to the revised estimates of the Philippines Statistics Authority, real GDP contracted by 9.6% in 2020, with Q4 2020 economic growth at -8.3%.

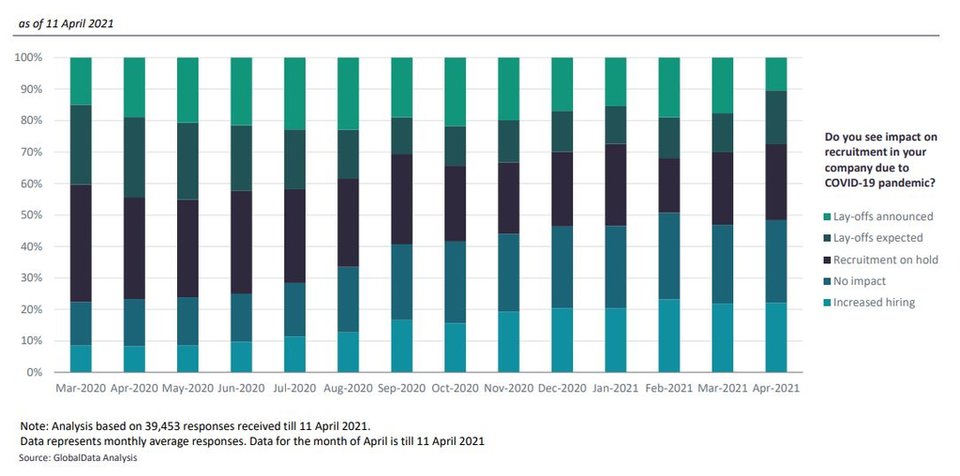

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 8 April

COAL

Thermal coal prices improved over December 2020 and January 2021, helped by rising demand from China and Japan due to cold weather. However, they fell sharply in early February, before improving over the rest of the month and into March. Prices finished at $84.15/t, 7.0% up on average in March compared with February 2021.

PRECIOUS METALS

The gold price reached an all-time high of $2,067/oz in early August 2020, before gradually declining to $1,896.49/oz at the end of the year. After passing $1,900/oz in early January, the price has gradually fallen over 2021 and fell below $1,700/oz in March – the first time it has fallen below that level since June 2020.

After peaking at $29.4/oz in January, the price of silver has dropped, and was $24.24/oz on 30 March, amidst improvements in US bond yields and the US dollar

BASE METALS

After reaching a high of $9,614.50/t in late February off the back of increasing demand and depleting inventories across the exchanges, the price of copper fell to 8,788.5/t by 30 March, as inventories rose from 73.7kt on 2 March to 144.5kt on 31 March.

The price is expected to remain high in 2021, however, supported by improvements in the global economy, continued demand from China to support infrastructure and other investments, and rising industrial demand.

IRON ORE

The iron ore price started the year at $163.93/t and passed $170/t on 19 January, before dropping back to $148.4/t on 2 February. It later peaked at $174.94/t on 5 March, rising due to concerns over supply curbs in China. Port stocks were 131 million tonnes by end of March however, above the highest point in 2020.

PALLADIUM & PLATINUM

Growth in industrial demand helped to push the price of platinum to a six-year high of $1,325/troy oz in February. Although it has subsequently fallen, it averaged close to $1,200/troy oz in March.

In 2021, prices will be supported by improved demand from the auto and industrial sectors, although this will be balanced by significant growth in supply after 2020 challenges, which is expected to lead to only a marginal increase in average price in 2021.