REGIONAL FOCUS

A new dawn: could a start-up mentality change Madagascan mining?

As the mining industry shifts, new minerals and jurisdictions come to the fore, and graphite mining in Madagascar is one such area receiving new attention. JP Casey asks: with a chequered past of foreign investment in its mining sector, could a start-up mentality help usher in a new dawn for Madagascan mining?

A

s the world’s mineral deposits are depleted, miners are forced to look further afield for productive mining enterprises. Similarly, as technological innovations spread throughout the world, minerals and metals that were once an afterthought are now at the forefront of the mining industry.

These conditions have combined to shine a light on a relatively new component of the global mining sector: graphite mining in Madagascar.

However, much of this work has been controversial, with allegations of environmental and social destruction dogging many of the developments in this field. Rio Tinto in particular has come under fire for its pollution of Madagascan water sources with lead and uranium, and separate instances of famine and poverty affecting people tied to its projects.

Yet the lucrative potential of Madagascar’s graphite deposits means that it remains an attractive investment destination, with the global demand for graphite set to increase by around 15 times over the next decade, driving the graphite market to a value of almost $30bn by 2022.

One company that looks to learn from the mistakes of miners like Rio Tinto, and capitalise on Madagascar’s vast mineral potential, is Tirupati. The company aims to bring a small-scale, modular approach to mining that could sidestep many of the environmental and social issues that have affected mining in Madagascar in the past. Could this new approach herald a new dawn for Madagascan mining?

Modular mining

“We have two projects in Madagascar, close to each other,” says Shishir Poddar, executive chairman of Tirupati. “Across the two projects, one is operational, where we commissioned a small plant as a start-up or proof of concept a couple of years back, that has been producing and shipping graphite from Madagascar across the globe.

“On the second project, that is 9,000-tonne capacity; so the two take us to a total of 12,000 tonnes in the next quarter. Over the next three years, we will be building these two projects to an 84,000-tonne capacity.”

This rapid expansion, from proof of concept to significant volumes of ore produced in just a few years, is owed to an approach that Poddar described as “modular”.

Instead of investing in a single, large project, and aiming to pull vast quantities of ore out of the ground immediately, Tirupati has developed smaller, more flexible facilities that can begin commercial production quickly, and then be scaled up at a later date.

We are building our company from a humble start to a level that is 28 times [the size] of our first plant.

“The purpose of that [modular approach] is to scale up in a step-by-step way, and ensure that you do not have very heavy start-up capital requirements, and you can address every situation in a country that is a new land for you,” explains Poddar, highlighting how this approach can sidestep many of the uncertainties and unknown risks associated with investing in a new mining jurisdiction.

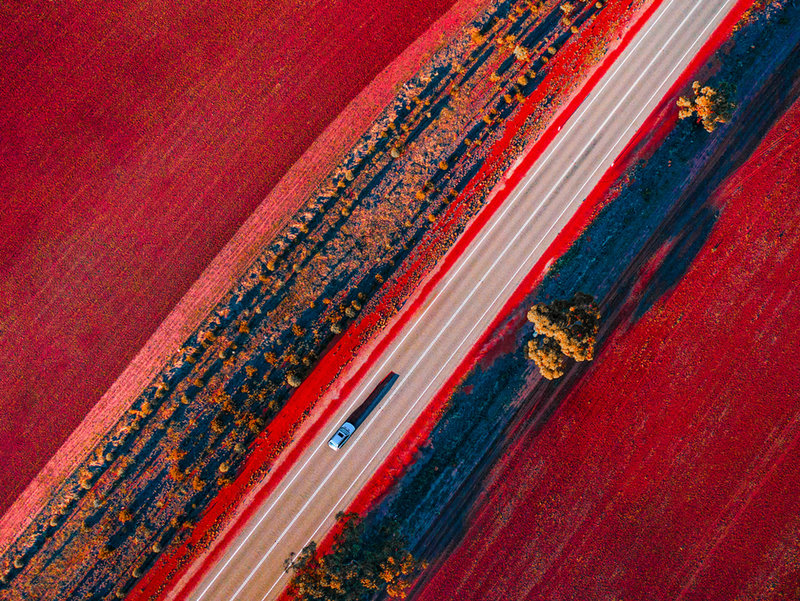

“We are building our company from a humble start to a level that is 28 times [the size] of our first plant,” he continues. “We have chosen our projects in a manner that we do not have to face huge infrastructure concerns: we chose our projects in areas where there were approach roads or highways already in operation, and close ports from where we can ship our produce.”

This approach could help the company catch up to some of the world’s largest graphite miners in record time. The largest operating graphite mine in the world is Syrah’s Balama facility in Mozambique, which has reached annual production of around 104,000 tonnes of the mineral.

With Madagascar boasting graphite reserves of some 26 million tonnes, the fourth-most in the world, there is every chance that Tirupati could come to dominate global graphite production in the near future.

Challenging conditions

Yet this is not to say that Tirupati’s work in Madagascar has been entirely straightforward, or that its future is set to be an easy journey to the top of the graphite pyramid.

In addition to the challenges facing any miner operating in a foreign country, from start-up costs to engagement with local groups, a recent embargo on new mining permits in Madagascar threatens new mineral development across the country, from which Tirupati has not been spared.

“There is an embargo in grants of new permits, although existing permits can be acquired or transferred to other buyers who intend to develop them,” says Poddar.

“We do have a few new permits that have been applied for and I'm expecting, because of what we are doing on the ground and the way we work, we should be able to get the favour of the government for that additional chunk of land, which helps us."

There is an embargo in grants of new permits, although existing permits can be acquired or transferred.

This uncertainty owes a lot to recent mining projects in Madagascar, which have attracted controversy for their social and environmental damage.

QIT Minerals Madagascar, owned by mining giant Rio Tinto, has destroyed around 6,000 hectares of indigenous forest around its operations; polluted local water sources with up to 50 times the concentration of uranium considered safe by the World Health Organisation; and caused tensions to become strained with local indigenous groups, all according to a single piece published in The Ecologist.

These controversies have led to tensions in the Madagascan Government, which has tried to balance the lucrative economic potential of encouraging foreign investment in its mineral sector with safeguarding indigenous people and environments.

// 3D System Model and Completed Installation. Credit: Deimos

Changing narratives

In 2019, the government tried to sweep a new mining bill into law, which was eventually rejected by the cabinet. The following year, the country’s supreme court criticised the state’s handling of the permitting of a project owned by Australian firm Base Resources, which led to the suspension of work and questions being raised about the government’s role in mining more broadly.

As a result, a narrative is beginning to emerge around Madagascar as an unstable or insecure mining jurisdiction, especially for foreign companies, one that Poddar is eager to change.

We use the entire overburden for land reclamation, and we've actually reclaimed land that's now used in agriculture.

“I would not say that there are serious issues, [and] I will say that it is a conducive place to work,” he says. “We are not only aiming to change narratives, they have actually changed. There are a lot of social activities that we perform, which actually help people; healthcare facilities are being put in place, we've been supporting primary schools across both our projects.”

“We use the entire overburden for land reclamation, and we've actually reclaimed land that's now used in agriculture,” he continues. “Coming to the tailings, we developed a new technology which, when we feed into the plant as ore, 50% of that is recovered as a by-product in the form of sand; that sand is what we are using for construction across all our developments there.”

// Main image: 3D System Model and Completed Installation. Credit: Deimos

A new dawn in Madagascar and beyond?

Tirupati’s combination of initial investment on a small scale and incorporating waste management and social responsibility into the heart of its operations could set a new precedent for mining in Madagascar.

“We have actually transformed the quality of life of thousands of people across our two projects, not only by way of employment that we generate ourselves, but in many other ways, [such as] secondary employment generated,” says Poddar.

“In such poor countries, if you come to them to make them understand that, 'I'm here to put in development, which helps you', and you prudently do that, you actually get a social licence,” Poddar continues.

“That's how it's worked for us. It's not only about getting a social licence for us, it's also a concept as a company. If we are not able to improve the quality of life of people who we are working with, then we have not achieved our objectives.”

We have actually transformed the quality of life of thousands of people across our two projects.

Tirupati’s aims are as ambitious as they are admirable, but questions remain as to whether this approach can be replicated on a larger scale. Not just for the company as it looks to expand its operations, but for the global mining industry, a vast sector with a chequered past with regard to social and environmental responsibility.

Translating this start-up mentality to an international scale is a challenge that Poddar is aware of, and one that he is cautiously optimistic about tackling.

“I would definitely think that this strategy that we have adopted could be used in many projects, [but] I may not say that it will be useful in every project,” he says.

“When you're talking about minerals like iron ore, they have a very different ecosystem. However, in my personal opinion, if you have the opportunity for early stage cashflow generation, while you may continue your studies, it actually helps you as a company.

“You are a revenue-generating company, expanding within the ecosystem for the investor world. I would think it's a concept that may need to be tweaked in accordance with each project and commodity, but it is something to think about.”

// Main image: 3D System Model and Completed Installation. Credit: Deimos