DEALS ANALYSIS

Deals activity: North America leads in deal value; silver falls behind other commodities

Powered by

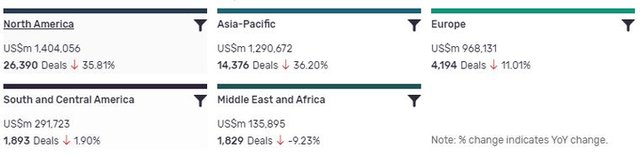

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are up year-on-year (YoY) across most regions.

North America is leading in terms of deal value ($1,404,056m), but its 35.81% YoY growth has been narrowly bested by Asia-Pacific (36.2%). Europe and South and Central America have also managed to maintain a positive growth, with increases of 11.01% and 1.9% respectively.

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa, with the region seeing a decline of -9.23%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 452877 | 23481 | 23.86 |

| Asset Transaction | 529275 | 10538 | -1.54 |

| Acquisition | 2056784 | 9055 | 31.77 |

| Debt Offering | 803841 | 2496 | -12.56 |

| Partnership | 3417 | 1383 | -74.35 |

| Private Equity | 62798 | 658 | 51.3 |

| Venture Financing | 1375 | 225 | -69.49 |

| Merger | 52539 | 209 | -65.27 |

A breakdown of deals by type and volume shows a general downturn, with acquisitions up 31.77% YoY, mergers down -65.27%, partnerships down -74.35%, and asset transactions down -1.54%. Financing deals have seen a similar downturn, with venture financing down -69.49% YoY and debt offerings down -12.56%, although equity offerings are up 23.86%. Private equity has seen surprisingly good growth, with a 51.3% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the continuing strength of gold. All other sectors have retained their relative rankings by volume from the year before, though other commodities have risen above silver once more. In 2020, other commodities saw 1,363 deals, while silver saw 1,368. Other commodites have so far in 2021 accrued 307 deals, while silver has seen only 237.

Note: All numbers as of 16 April 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

MetRes to acquire mothballed Australian coal mines from Peabody Energy

The MetRes joint venture (JV) between Stanmore Coal and M Resources has agreed to acquire the Millennium and Mavis Downs coal mines in Australia from Peabody Energy.

The JV signed an agreement to purchase the mines, which are currently in care and maintenance, for an upfront cash consideration of nearly $1m (A$1.25m) and a royalty agreement, which is capped at $1m (A$1.25m).

Regis Resources to acquire stake in Tropicana gold project for $688m

Regis Resources has agreed to acquire a 30% interest in the Tropicana gold project in Western Australia firm Independence Group for $688.3m (A$903m) in cash.

Rio Tinto and Turquoise sign financing deal for Oyu Tolgoi expansion

Rio Tinto has signed an agreement with Turquoise Hill Resources on an updated financing plan for the $2.3bn underground development of the Oyu Tolgoi copper-gold mine in Mongolia.

CATL to acquire stake in DRC’s Kisanfu copper-cobalt mine in $137m deal

Battery maker Contemporary Amperex Technology (CATL) subsidiary Ningbo Brunp CATL New Energy will be acquiring a stake in the Kisanfu copper-cobalt mine in the Democratic Republic of Congo (DRC) for $137.5m.

Stantec plans to acquire mining project delivery consultant Engenium

Canada-based engineering firm Stantec has signed a letter of intent to purchase Engenium, an Australian mining project delivery and advisory services firm.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.