SUPPLY CHAIN

Covid-19 majorly disrupted mining supply chains – was it a taste of things to come?

South Africa’s state-owned ports and rail operator, Transnet, experienced disruptions at the start of 2021 owing to the impact of Cyclone Eloise on its lines. With Transnet also responsible for transporting mining commodities out of the country, Matthew Hall looks at the increasingly common threats to the mining supply chain.

A

successful mining company can rise or fall on the efficiency and resilience of its supply chain – one look at disruptions on both sides of the supply and demand equation through the Covid-19 pandemic can tell you that.

Unprecedented global calamities aside, the mining industry is a supply chain business at its core: get a material out of some rocks in the ground, get the material processed, get the material to the people that need it.

And while it may be tempting to look at the coronavirus pandemic as a once in a lifetime catastrophe, a big obstacle on an otherwise open road, supply chains are threatened with increasingly common – and increasingly unpredictable – disruptions. Also, bad news: climate change and ecological breakdown is probably going to make viral pandemics more common. So much for Fleetwood Mac’s promise that you’ll never break the chain.

Changing weather patterns could hamper vital steps in the supply chain

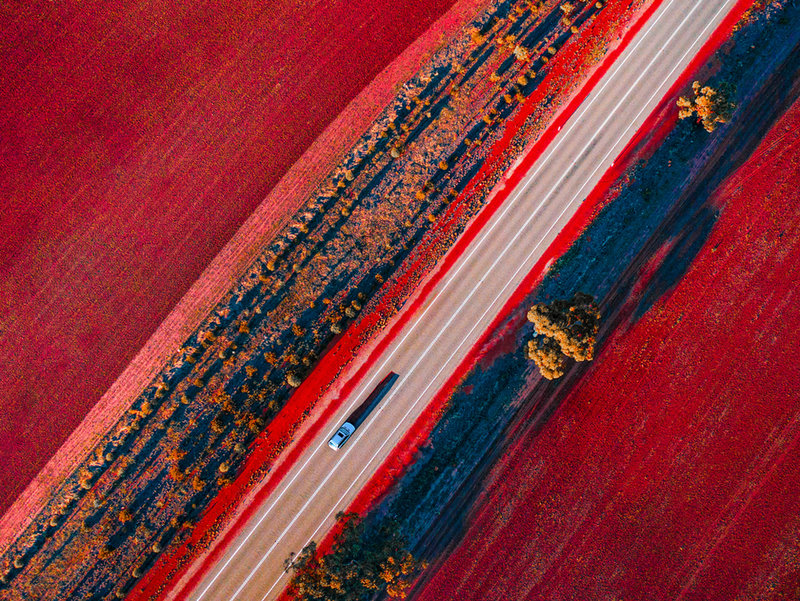

Cyclone Eloise hit parts of southeast Africa in January, with persistent heavy rain causing floods in the South African province of Limpopo, damaging buildings and infrastructure, and strong winds knocking over trees.

Transnet’s freight-rail unit had to slow its iron ore and manganese deliveries because of damage wrought by the tropical storm – heavy rainfall had scoured away soil at the base of the tracks, leading to potential derailments. Transnet’s Richards Bay Terminal – a port with 13 berths that handles dry bulk ores, minerals, and break-bulk consignments – declared force majeure in early February due to Eloise.

The disruption to the transport systems that South African miners rely on to move commodities poses a supply chain risk to mining companies. Transnet cited “increased changes and unpredictability in weather patterns” as spurring it to enact measures to counter the effects that adverse weather can have on its network.

Transnet’s Richards Bay Terminal declared force majeure in early February due to Eloise.

Last year, McKinsey Global Institute published a study identifying the ways that climate change could expose weak links in a company’s supply chain. The report cited a changing climate and, with that, more frequent or more severe weather patterns or natural disasters, as potentially interrupting production, raising costs, or hurting revenues.

Particularly prescient for miners is the risk of drought. Water is vital across the mining industry, used to cool machinery, process minerals, dampen dust, and myriad other processes. Mines can typically source water from groundwater, rivers and lakes, or commercial suppliers, but many mine sites are in locations where water is already scarce.

But drought can affect the mining industry far beyond on-site activities. The Panama Canal shortens an 8,000-mile journey around Cape Horn to just 48 miles, but in drought conditions, ship operators are having to reduce the weight of their cargo due to the reduced water levels in the canal.

Mining supply chains are becoming increasingly politicised

For several years now, global supply chains have been pressured by geopolitical tensions between the US and China, bringing potential problems for companies that rely on Chinese suppliers, or supply to China themselves.

Whether it’s the US seeking new suppliers for critical minerals and potentially freezing out companies with strong ties to the Chinese market, or China’s ban on Australian coal leaving Australian cargo ships stuck off the Chinese coast, miners find themselves increasingly beholden to the whims of international politicians.

And with mined commodities vital to the future of energy and to the infrastructure needed for a green economy, metals are becoming increasingly politicised. From US President Biden’s climate plan to the EU’s €500bn ($586bn) green stimulus, investment is expected to flow heavily into the metals required for electric vehicles, renewable energy infrastructure, and battery storage systems.

While the uplift in investment may spell good fortunes for producers of battery metals and rare earths, there are concerns this could be a double-edged sword, bringing more intense government involvement and interference. Quite understandably, if you pump a few hundred billion into kickstarting a green transition, you will probably want to keep a close eye on those investments.

Copper producers finding themselves in a boom period are being increasingly financially pressured by their host nations.

For mining companies, this involvement could manifest as inconvenience – with supply chains wrapped up in more bureaucracy and miners increasingly subject to the political whims of government backers.

This is being accelerated as countries look to rebound from the economic downturns induced by the pandemic. Copper prices have doubled over the course of the pandemic, and Bloomberg reported recently that copper producers finding themselves in a boom period are being increasingly financially pressured by their host nations.

While it’s not unusual for nations to want to cash in during high price periods, extra incentive is coming from the need to fund post-pandemic recovery plans. A candidate in Peru’s presidential election, Yonhy Lescano, bounced to the top of the polls in March; a key pillar of his campaign is taking a tougher stance against mining companies, to ensure more revenues from the country’s vast copper resources are collected by the state.

// 3D System Model and Completed Installation. Credit: Deimos

Cyber threats to the supply chain

As mines become increasingly digital, the number of potential doors for cyber breaches increases too. For several years now the industry has been threatened by cyber attacks that aim to exploit mining’s strategic position within wider industrial supply chains. Hostile governments, criminals, or hacktivists can benefit greatly by targeting the supply chain for mined commodities.

Attacks are two-fold in motive: metals and minerals play a key role in national economies and hackers can gain leverage over regional and national supply chains by targeting miners; plus, the uptick in reliance on digital or automated systems at mines means that mining operations can be more exposed.

A decade ago, hackers linked to China engaged in cyber attacks on law firms, financial institutions, and public relations agencies that were working with BHP, in apparent attempts to obtain information about BHP’s (unsuccessful) bid for Canadian company PotashCorp.

97% of mining companies surveyed admitted their cybersecurity systems were not meeting their needs.

While the law firms targeted were not expressly part of the supply chain of any BHP commodities, the attempts at cyber espionage were an early warning shot to the industry that hackers can exploit vulnerabilities in associated companies rather than targeting the miner directly.

With mines undergoing digital transformations – bringing in autonomous vehicles and equipment or advanced analytics software – third party vendors can become targets themselves, presenting hackers with a means to target part of a mine’s digital control system, or tamper with commodity transports to disrupt operations.

Outside the mining industry, this was the method that breached multiple parts of the US federal government and thousands of other organisations when the hackers breached American software company SolarWinds.

A 2018 report from EY found that 97% of mining companies surveyed admitted their cybersecurity systems were not meeting their needs, even as a majority of companies reported a cybersecurity incident within the two years prior. Almost half thought that their organisation would be unable to detect a sophisticated cyberattack.

// Main image: 3D System Model and Completed Installation. Credit: Deimos