DATA

Deals analysis: mining industry mergers and acquisitions total $9.8bn globally in May 2022

Metals and mining industry mergers and acquisitions worth $9.8bn were announced globally in May 2022, led by Gold Fields’ $6.7bn acquisition of Yamana Gold, according to GlobalData’s deals database.

Powered by

The value marked an increase of 24.9% over the previous month of $7.84bn and a rise of 77.03% when compared with the last 12-month average, which stood at $5.53bn.

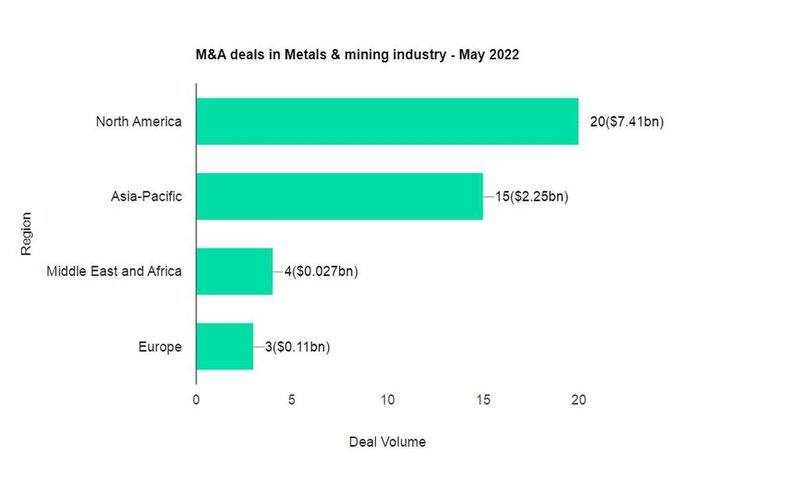

Comparing mergers and acquisitions (M&A) deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $7.41bn. At the country level, the Canada topped the list in terms of deal value at $7.4bn.

In terms of volumes, North America emerged as the top region for industry M&A deals globally, followed by Asia-Pacific and then Middle East and Africa.

The top country in terms of M&A deals activity in May 2022 was Canada with ten deals, followed by the US with eight and China with five.

In 2022, as of May, metals and mining M&A deals worth $25.67bn were announced globally, marking an increase of 103.04% year on year.

The top five M&A deals accounted for 97.8% of the overall value during May 2022. The combined value of the top five metals and mining M&A deals stood at $9.57bn, against the overall value of $9.8bn recorded for the month.

Of those tracked by GlobalData, the top five deals were:

- Gold Fields $6.7bn acquisition of Yamana Gold

- Seroja Investment’s $2bn acquisition of Denway Development

- Sandstorm Gold’s $646.37m acquisition deal with Nomad RoyaltyLtd

- The $120m acquisition of OM Materials (Samalaju) and OM Materials (Sarawak) by OM Materials

- Stanmix Holding’s $105m acquisition deal with AO Kun-Manie