COMPANY INSIGHT

Sponsored by: Enthalpy

INSIGHT

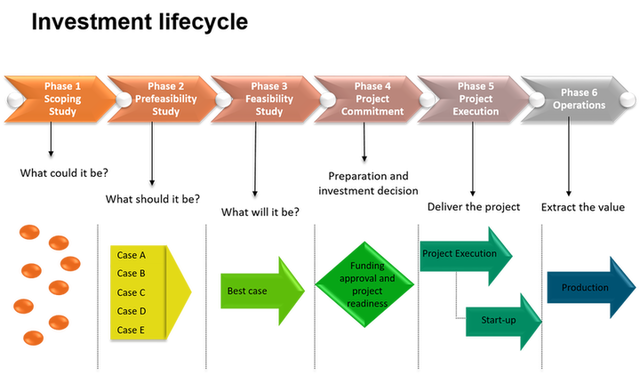

Investment dimensioning is the key to early business case selection and definition

In the world of long-term investment lifecycles, making sure that the best business case is chosen from a range of options is absolutely pivotal to the future phases of that investment.

What is Investment Dimensioning?

Investment Dimensioning is a method used to facilitate selecting the best business case from a range of options.

The Investment Dimensioning Method:

- Utilises a defined methodology to think creatively about investment options;

- Defines the conceptual business case to create various investment cases to study

- Selects the best case for further definition

- Reduces the potential for costly rework

Top Benefits of Investment Dimensioning

- Ensures shareholder value is maximised by understanding the risk / reward relationship for an investment opportunity

- Defined process that recognises the opportunity cost of investment decisions

- Investments are an irrevocable commitment of resources with an uncertain outcome

- Investments are an irrevocable commitment of resources with an uncertain outcome

- Helps companies make better decisions

- Quickly rank issues to define problem / opportunity

- Develop alternative approaches to consider

- Identify key risks and uncertainties to control or monitor

- Reduces the potential for costly rework

More than half of the country’s coal mines are managed by pro-Russian separatist militia.Credit: DmyTo/Shutterstock.

Credit: Enthalpy.

Four parts to Investment Dimensioning

Part 1 – Opportunity Framing

- Opportunity statement

- KPIs for success

- A list of hurdles to success

- Alternate investment cases

Part 2 – Dimensioning

- Framing the opportunity into strategic themes

- Influence diagrams around investment decision, probability of success, NPV and variables to create alternate investment cases

- Select investment cases for future study

Part 3 – Study alternate investment cases

- Completed Scoping Study

Part 4 – Select best case

- Completed Prefeasibility Study

Credit: Enthalpy.

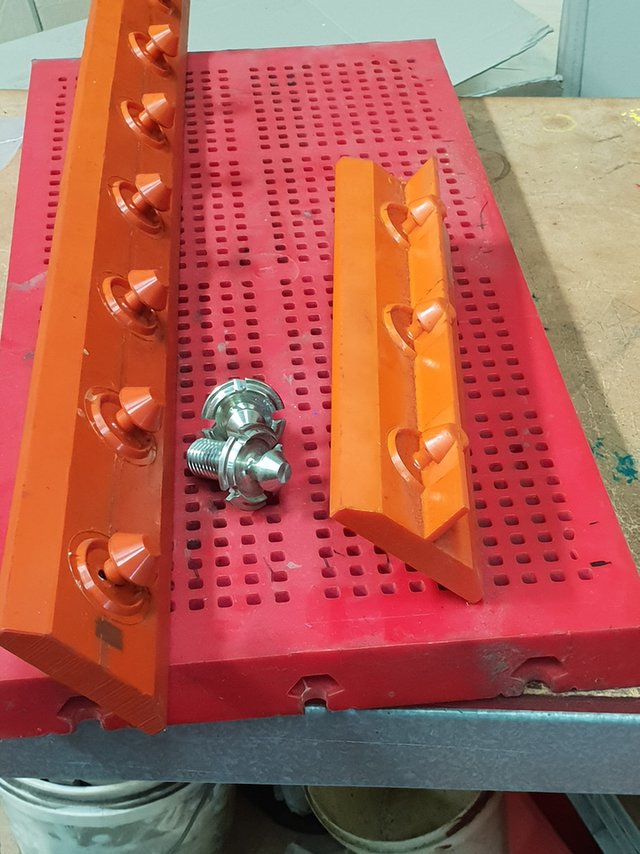

Expert Hands On The JOB

First of all, you get to work directly with engineers who are hands on with the job. Our chief consultants are skilled in taking your project, whether big or small, from discussion brief through to specs and drawings. If there is tooling required our pattern makers will design the right dies and casts for the job. In fact, we can even save you money by producing tooling to replace costly imported polyurethane components. Ask us for further details.

First of all, you get to work directly with engineers who are hands on with the job.

When Experience Counts

From experience, we can offer you a guarantee on our work if we have the right specifications for the job from the start. That’s an indication of the value we place upon our output at Engineering Plastics. And given the fact there are so many variables in the work we do, we take the time to discuss all the details from the start by mapping out exactly what you require. You can rest assured the final product is manufactured using the highest quality polyurethane and rubber around.

IMS Overfill Prevention System Masterfile

More than half of the country’s coal mines are managed by pro-Russian separatist militia.Credit: DmyTo/Shutterstock.

Who we’ve assisted with Capital Investment Systems

Over the past 30 years, Enthalpy has worked internationally with the following mining and energy companies to implement successful Capital Investment Systems; we’ve helped them set up systems that allow them to invest in the right projects.

|

|

More than half of the country’s coal mines are managed by pro-Russian separatist militia.Credit: DmyTo/Shutterstock.

Investment Dimensioning is critical towards understanding the risk and reward relationship at any early investment opportunity stage.

Enthalpy has created a stepped investment dimensioning methodology to define a selected business case, which is highly practicable and deliverables focussed. This methodology fits within Enthalpy’s Capital Development system. The CIS and processes used by a Company are critical to the competitive edge of any business.

Every year, the demands for greater effectiveness from shareholder funds will increase as this is a natural evolution found in business.

This article was written by Luke Epstein, Associate Partner at Enthalpy

More than half of the country’s coal mines are managed by pro-Russian separatist militia.Credit: DmyTo/Shutterstock.