Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 February

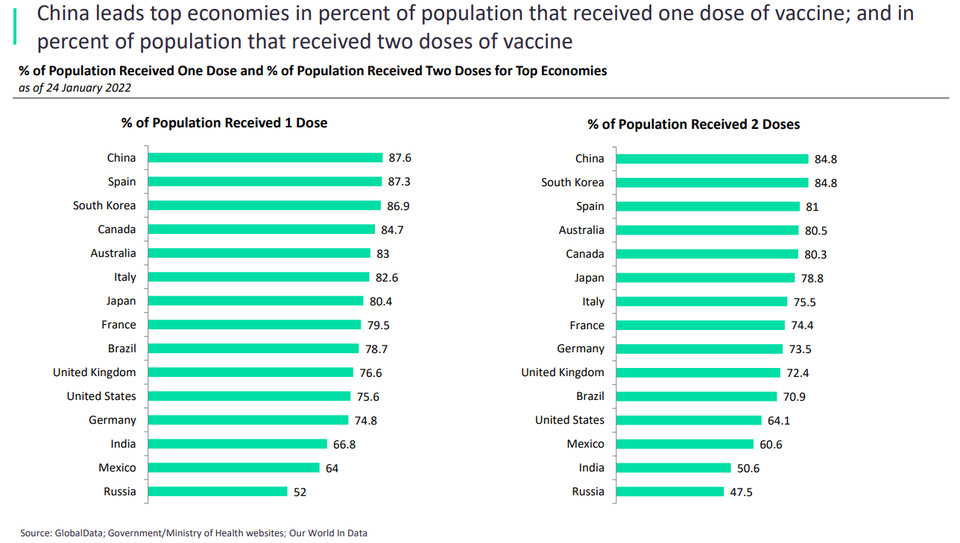

China leads the world in total vaccines administered, with 2.9 billion. This is ahead of India, with 1.6 billion, and the US, with 534 million. No other countries have more than half a billion vaccines.

Gibraltar leads the world with 3,275 vaccines administered per thousand people, ahead of Cuba and Malta. The US has recently dropped out of the top ten in this category.

120.6%

Gibraltar leads the world in percentage of its population vaccinated, with Gibraltar offering vaccines to those from abroad to push its percentage over 100%.

30%

Around one-third of people in the US to have received two Covid-19 vaccines have also received a booster dose.

Covid-19 vaccinations around the world

- SECTOR IMPACT: MINING -

Latest update: 4 March

PROSPECTING AND EXPLORATION

In the short term, continued travel restrictions will hinder explorers, whilst investor sentiment will impact capital raising. In the long term, rising prices and the need to meet rising future demand for battery commodities and critical minerals will support exploration activity.

MINE DEVELOPMENT

Immediately, as commodity prices improve and restrictions ease, capex is set to rise, with developments constrained mainly by the ability to source the required workforce and avoid Covid-19 cases on site. In the long term, recovery in commodity demand and prices will spur an increase in mine development activity to meet future demand requirements.

EXTRACTION AND PROCESSING

In the near-term, miners are increasingly meeting production guidance unless non-Covid-19-related impacts have led to reduced output. Beyond this, mines have seen improvements to emergency response plans and investments in worker health, as well as an increased investment in technology and automation.

MARKETING

In the short term, recovery in China and public sector investments supported rising commodity demand in 2021 for industrial production and infrastructure construction. In the long term, as the global economy returns to growth, with rising demand from construction and renewables sectors, demand growth for commodities will return to pre-Covid-19 expectations.