After a 4.2% decline in 2020, coal production from the top 10 companies is expected to increase by up to 6.6% in 2021, says GlobalData

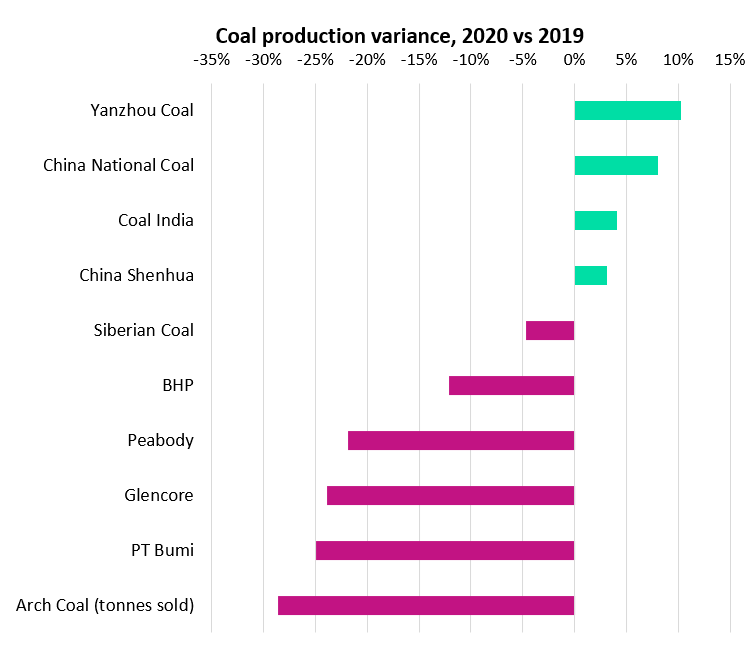

Coal production from the top ten companies fell from a collective 1,704Mt in 2019 to 1,633Mt in 2020 – a 4.2% decline. The most significant declines were observed from Arch Resources (28.6%), PT Bumi (24.9%), Glencore (23.9%), and Peabody (21.8%).

Production from Arch Resources (formerly Arch Coal) declined primarily due to the sale of the Holden #22 Surface mine in December 2019, coupled with weak economic conditions during Q1 2020. In addition, the temporary suspension of the Viper mine in Q2 2020 further disrupted the company’s coal production. Heavy rainfall amid the outbreak of Covid-19 impacted PT Bumi’s output in 2020.

Glencore’s coal output fell for the fourth straight quarter as the company’s Colombian coal assets remained suspended as part of Covid-19 preventive measures. Scheduled production cuts across its Australian portfolio also impacted the company’s overall output, as did the Prodeco mine being placed under care and maintenance and strikes at Cerrejon between August and December 2020.

Credit: GlobalData

Peabody’s output dropped primarily due to the upgrade of the main line conveyor system at Shoal Creek, alongside pit sequencing work at Moorvale and a dragline outage at Coppabella. In addition, the company also suspended operations at the Wambo underground mine for around 59 days during the second half of 2020. Closure of mines including Kayenta and Cottage Grove (Q3 2019) and Wildcat Hills (Q2 2020) further impacted the company’s output.

BHP’s coking coal production was impacted by planned maintenance at the Saraji and Caval Ridge mines, environmental disruptions at La Nina, and lower yields at the South Walker Creek and Poitrel mines. Meanwhile, the thermal coal segment, from which the company is expected to exit in the near future, was affected by a 91-day strike at the Cerrejon project, which started on 31 August 2020.

In contrast, production from Coal India rose by 4%, owing to a recovery in the offtake from India’s power sector, which was supported by a resumption in industrial and commercial activities as the country’s electricity demand started to recover from Covid-19.

Output from China Shenhua, Yanzhou, and China National Coal Group also increased, rising by 3.1%, 10.2%, and 8.1% respectively in 2020, mainly owing to a quick recovery in China, particularly during the second half of 2020. Based on latest guidance, GlobalData expects production from the top ten companies to be between 1,683-1,740Mt in 2021 – up to 6.6% growth compared with the collective output in 2020 (1,633Mt).

MARKET INSIGHT from