After a 2% decline in 2020, global coal production is expected to rise by 3.5% in 2021, says GlobalData

Global coal output, impacted by Covid-19 related lockdowns and restrictions, is estimated to have declined by 2% in 2020, with significant reductions observed in the US (23.6%), Indonesia (13.1%), Russia (8.1%), and Australia (5.5%).

These were only partially offset by increases in China (4%) and India (0.7%). Also during the last year, there was an estimated 3.5% reduction in the global thermal coal demand, while the world’s metallurgical coal demand fell by 5.9%.

With the US coal industry already challenged by high production costs and low natural gas prices, the country’s output was severely impacted by the Covid-19 pandemic, with key companies halting their operations in line with preventive measures. Additionally, a decline in domestic and export market demand affected output from Indonesia and Russia.

Looking ahead, global production is set to recover by 3.5% to eight billion tons in 2021. In China, growth of 2.5% is expected, supported by the commencement of projects including Dahaize and Xinjiang Zhundong.

India, which after flagging coal as an essential commodity reported 0.7% growth in 2020, is expected to deliver 9% growth in output to reach 827.8Mt in 2021. The commercial auction of coal mines in India is expected to be a key production booster for the world’s second-largest coal producer.

In early 2020, the Indian Government gave clearance to begin operations for 10 coal projects that included Kusmunda (62.5Mt at full capacity) in Chhattisgarh and Rajmahal (24Mt) and Lakhanpur (21Mt) in Jharkhand.

Credit: GlobalData

Other countries that are anticipated to bounce back strongly during 2021 include the US (9.3%) and Russia (8.4%). By contrast, production from Australia is expected to decline by around 4% in 2021, mainly because of concerns over the future of China-Australia trade.

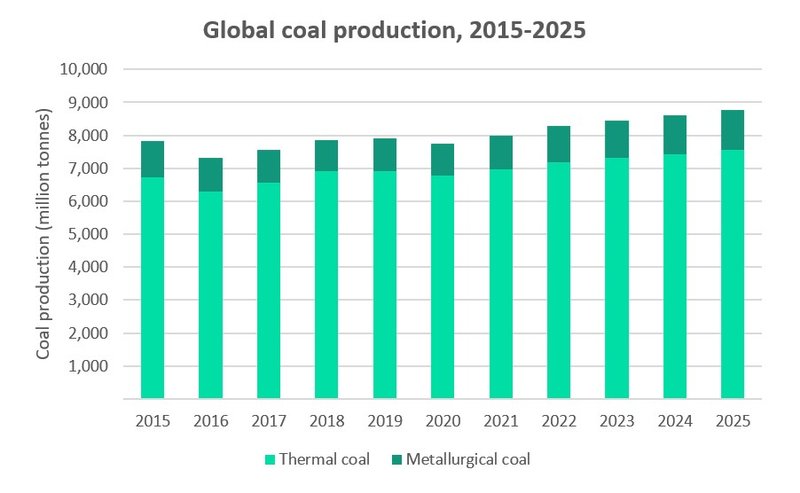

Global coal production over the forecast period (2021–2025) is expected to grow at a CAGR of 2.3% to reach 8.8Bnt in 2025. While thermal coal production is expected to have a relatively marginal 2% CAGR, to reach 7,549.6Mt, metallurgical coal is forecast to register stronger growth of 4.2% per year, to reach 1,216.9Mt in 2025.

India will be the largest contributor to this growth. Its production is expected to increase from 777.7Mt in 2020 to 1.2Bnt in 2025. This will be followed by China, Indonesia, Australia, and South Africa, whose combined production is expected to increase from an estimated 5Bnt in 2021 to 5.43Bnt in 2025.

// Main image credit: Rob Bayer/Shutterstock

Market Insight From