Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 14 April

After months of decline, GDP estimates for many countries have turned positive.

In 2021, employment prospects have shown the most improvement to date in the month of February.

6.5%

The Spanish government downgraded its economic growth forecast for 2021 to 6.5% from its earlier projection of 7.2%.

9.6%

According to the revised estimates of Philippines Statistics Authority, real GDP contracted by 9.6% in 2020, with Q4 2020 economic growth at -8.3%.

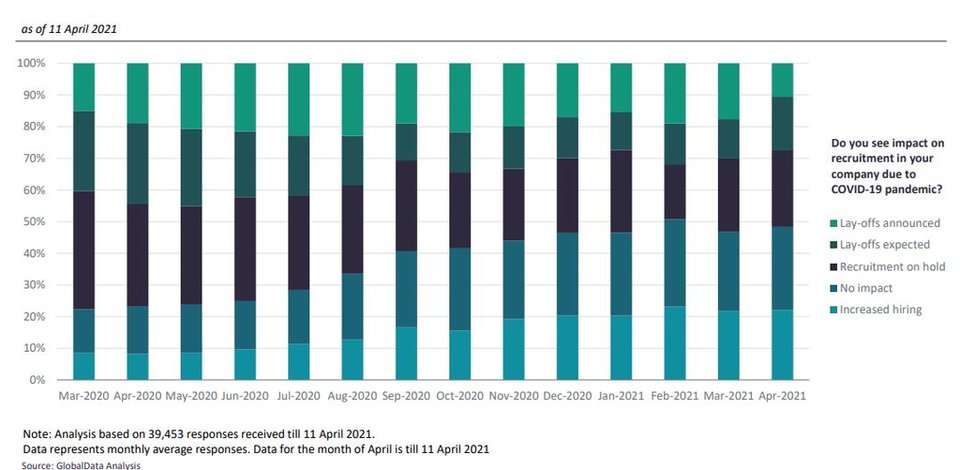

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 6 May

COAL

Thermal coal prices improved over December 2020 and January 2021, helped by rising demand from China and Japan due to cold weather. However, they fell sharply in early February before improving over February, March and April to finish at $85.57t, with an average increase for April versus March of 2.1%.

PRECIOUS METALS

After falling to a low point of $1,678 in March, the gold price gradually improved, reaching $1,792.3/oz on 21 April and ending the month on $1,769/oz. An improving economic outlook is dampening prospects for a rise in the gold price, although gold prices will be supported by continued low interest rates in 2021. Demand for gold fell significantly year-on-year in Q1 2021, down 23% to 815.7 tonnes due to heavy selling by investors, despite increased demand by consumers.

BASE METALS

After reaching a high of $9,614.50/t in late February off the back of increasing demand and depleting inventories across the exchanges, the price of copper fell to 8,788.5/t by 30 March. However, the copper price rose during April by over $1,000/t to reach $9,990 on 29 April.

IRON ORE

After dropping back to $163.7/t early in April, the iron ore price rose steadily to reach $179.3/t by the end of the month. Prices have been supported by underwhelming output from the large producers in the early part of 2021. In the March quarter, iron ore production by Rio Tinto fell by 2% YoY, BHP’s production was down almost 2%, whilst Vale’s output fell by 19.5% on the prior quarter. However, BHP did state that its full-year output was expected to be at the upper end of its forecast.

PALLADIUM & PLATINUM

Growth in industrial demand helped to push the price of platinum to a six-year high of $1,325/troy oz in February. Although it has subsequently fallen, it averaged close to $1,200/troy oz in both March and April. In 2021, prices will be supported by improved demand from the auto and industrial sectors, although this will be balanced by significant growth in supply after the 2020 challenges.