DEALS ANALYSIS

Deals activity: North America leads value and growth; silver beaten out by other commodities

Powered by

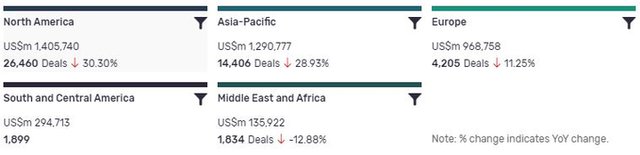

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are up year-on-year (YoY) across most regions.

North America is leading in terms of deal value ($1,405,740m) and YoY growth (30.3%). Asia-Pacific and Europe have also managed to maintain a positive growth, with respective increases of 28.93% and 11.25% .

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa, with a decline of 12.88%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 454142 | 23518 | 19.34 |

| Asset Transaction | 528738 | 10578 | -7.98 |

| Acquisition | 2056930 | 9082 | 36.9 |

| Debt Offering | 807388 | 2499 | -12.03 |

| Partnership | 3417 | 1387 | -55.31 |

| Private Equity | 63810 | 662 | 60.29 |

| Venture Financing | 1375 | 227 | -71.72 |

| Merger | 52541 | 211 | -65.24 |

A breakdown of deals by type and volume shows a general downtrend, while acquisitions are up 36.9% YoY, mergers are down -65.24%, partnerships down -55.31%, and asset transactions down -7.98%. Financing deals have seen a similar downturn, with venture financing down -71.72% YoY and debt offerings down -12.03%, although equity offerings are up 19.34%. Private equity has seen surprisingly good growth, with a 60.29% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the continuing strength of gold. All other sectors have retained their relative rankings by volume from the year before, though other commodities have risen and remained above silver. In 2020, other commodities saw 1,394 deals, while silver saw 1,401. Other commodites have so far in 2021 accrued 345 deals, while silver has seen only 264.

Note: All numbers as of 06 May 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

Volt Resources to acquire 70% stake in ZG Group

Graphite and gold explorer Volt Resources has signed binding share purchase agreements to buy a 70% stake in the Ukraine-based Zavalievsky group of companies (ZG Group).

Fortuna Silver Mines to acquire Roxgold for $804m

Canadian company Fortuna Silver Mines has signed a definitive agreement to acquire all the issued and outstanding securities of West Africa-focused Roxgold in an $804m (C$1bn) deal.

Kazatomprom to sell stake in Ortalyk uranium mining operation

JSC National Atomic Company Kazatomprom has signed an agreement to sell a 49% stake in its wholly owned Ortalyk uranium mining operation to China General Nuclear Power Corporation subsidiary for $435m.

Nickel Mines acquires additional stake in Angel Capital

Australia’s Nickel Mines company has completed the acquisition of an additional 20% stake in Angel Capital, a Singaporean holding company that is ultimately the owner of the Angel Nickel project in Indonesia.

AngloGold grants approval to Regis Resources for Tropicana acquisition

AngloGold Ashanti has approved Regis Resources’ acquisition of a 30% interest in the Tropicana project in Western Australia from joint venture partner IGO.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.