New projects to support growth in Australian iron ore production in 2022

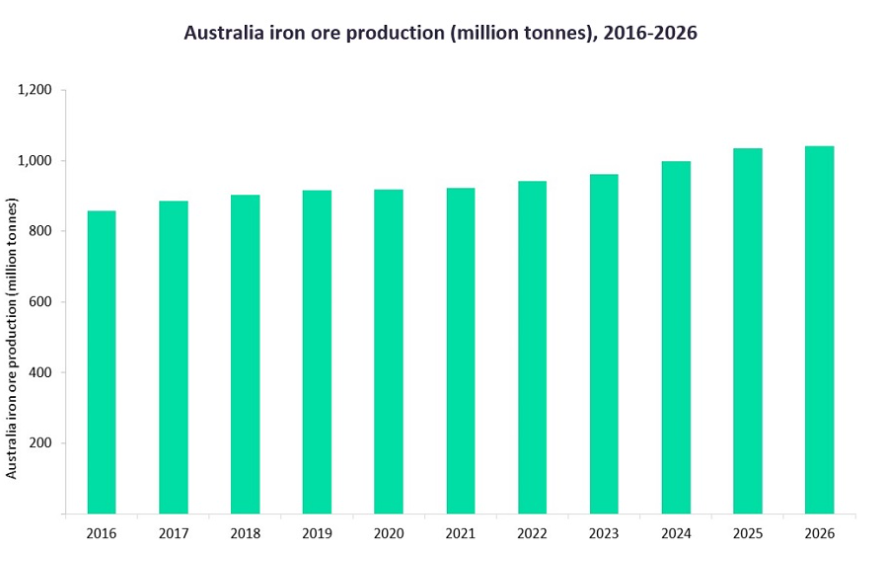

Over the next five years, Australian iron ore production is expected to grow at a CAGR of 2.6% to reach 1.04 billion tonnes in 2026.

Australia’s iron ore production is set to increase by 2% to 941 million tonnes (Mt) in 2022, backed by projects that began operations in 2021, such as South Flank, West Angelas, Mesas B, C and D and Western Turner Syncline Phase 2. The upper end of the iron ore production expectations from Rio Tinto and BHP equates to 594Mt in 2022, 16.8% higher than the 508.4Mt produced in 2021.

However, continuing labour shortages, alongside slowing demand from China due to environmental pledges and new Covid-related lockdowns and restrictions during Q1 2022, is scaring the global iron ore industry yet again.

// Main image:St Agnes, UK - 2018: Visitors of the Wheel Coates tin mine site, wearing hard hats and listening to one of the local guides. Credit: AmbrosiniV / Shutterstock.com

Steady growth

Overall, Australia produced 922.6Mt of iron ore in 2021, accounting for nearly 40% of the global total with a marginal increase of 0.5% over 2020.

Over the next five years to 2026, Australian iron ore production is expected to grow at a CAGR of 2.6% to reach 1.04 billion tonnes in 2026. This growth will be helped by the commencement of new projects and the expansion of the existing ones such as South Flank, which began in 2021 and is gradually expected to ramp up to its full capacity of 80Mt, replacing output from the Yandi mine, which is nearing the end of mine life (2023).

Projects with the potential to commence operations during the forecast period include FMG’s Iron Bridge, which is progressing on schedule and budget, with the first shipment of concentrate expected to be in December 2022. Simultaneously, construction activities at the Gudai-Darri project continue with operations expected to begin by mid-2022.

Supply chain delays, maintenance, weather disruptions and labour shortages due to Covid-19-related border restrictions were the key factors behind Australia’s restrained growth. However, the commencement of FMG’s Eliwana mine and ramp-up at BHP’s South Flank, partially offset the impact.

Rio Tinto’s iron ore production at Australian operations declined from 271.9Mt in 2020 to 263Mt in 2021, a 3.3% fall. Labour shortages, as well as commissioning delays, were key factors in the decline in production. In Q1 2022, the company’s production declined by 15% quarter-on-quarter (QOQ) due to increased on-site Covid-19 cases in the Pilbara, after the opening of Western Australia’s borders.

Meanwhile, planned maintenance activities, alongside a continued shortage of train drivers, hit BHP’s output, with a 10% QOQ decline. Last year, despite weather-related disruptions and rail labour shortage, BHP’s Australian supply increased, albeit by a marginal 0.1%, to 245.4Mt.

This was driven by record production at Jimblebar and Mining Area C, which included first ore from South Flank in May 2021.

Steel and beyond

Global steel production increased by 3.8% in 2021, helped by a strong post-pandemic economic recovery. However, steel production in China, which produces around half of the global steel and is also the largest market for Australian iron ore, fell by 3%.

Emissions-related production cuts, particularly during the second half of 2021, alongside sluggish domestic demand, impacted China’s output, with construction output growth in China slowing to just 2.1% in 2021, owing to a tightening of regulatory controls to limit borrowing by real estate developers. Overall, this was completely offset by growth in the US (18%), India (17.9%) and Japan (15.8%), which collectively produced 44.2Mt more steel in 2021 versus 2020.

Looking ahead, improvement in global demand is expected in 2022, helped by a marginally higher growth in construction output.

There remain uncertainties, however, in the short-term outlook, following Russia’s invasion of Ukraine. The war will exacerbate existing supply chain disruptions and put even greater upward pressure on energy prices, which will further drive up prices for key construction materials. Meanwhile, there are also still prevailing risks associated with the pandemic, particularly in markets with a “zero-Covid” policy, such as China.

COMMENT