DEALS ANALYSIS

Deals activity: North America leads in deal value and growth; gold retains lead by sector

Powered by

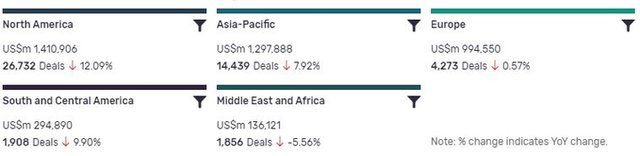

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are up year-on-year (YoY) across almost all regions.

North America is leading in terms of deal value ($1,410,906m) and YoY growth (12.09%). Europe and South and Central America have also managed to maintain a positive growth, with respective increases of 0.57% and 9.9%.

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa (-5.56%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 466050 | 23729 | 46.97 |

| Asset Transaction | 532463 | 10691 | 5.04 |

| Acquisition | 2075289 | 9158 | 37.81 |

| Debt Offering | 820111 | 2521 | -15.35 |

| Partnership | 3477 | 1413 | 235.35 |

| Private Equity | 63883 | 669 | 80.41 |

| Venture Financing | 1505 | 234 | 173.16 |

| Merger | 52541 | 216 | -97.02 |

A breakdown of deals by type and volume shows a general positive uptick, with acquisitions up 37.81% YoY, mergers down -97.02%, partnerships up a huge 235.35%, and asset transactions up 5.04%. Financing deals have seen a similar positive trend, with venture financing up 173.16% YoY, equity offerings up 46.97%, and private equity up 80.41%. However, debt offerings are down -15.35%.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the continuing strength of gold. All other sectors have retained their relative rankings by volume from the year before, though other commodities have continued to beat silver in 2021. In 2020, other commodities saw 1,397 deals, while silver saw 1,402. Other commodities have so far in 2021 accrued 439 deals, while silver has seen only 352.

Note: All numbers as of 15 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

China’s Ganfeng to acquire stake in Goulamina lithium mine for $130m

China’s Ganfeng Lithium has reportedly agreed to acquire a 50% stake in the Goulamina Lithium Project in Mali in a $130m deal.

LG Energy and POSCO to pick $15m stake in EV battery material supplier QPM

Queensland Pacific Metals (QPM) has signed an investment and offtake deal with battery maker LG Energy Solution and steel producer POSCO.

Orogen Royalties acquires Onjo copper-gold property in Canada

Orogen Royalties has acquired the Onjo copper-gold porphyry property in central British Columbia, Canada, for an undisclosed sum.

DPM signs agreement to acquire shares in INV Metals

Dundee Precious Metals (DPM) has signed a definitive agreement to acquire all of the issued and outstanding shares it does not currently own in INV Metals.

Emmerson and TCMG extend Tennant Creek alliance to Southern Project Area

Emmerson Resources and Tennant Consolidated Mining Group (TCMG) have expanded their alliance to include the Southern Project Area (SPA) in Tennant Creek, Australia.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.