Steep growth continues in the use of autonomous haul trucks, particularly in Australia and Canada

The popularity of autonomous haul trucks is gradually growing across surface mines, with miners taking advantage of improvements to productivity, reductions in accidents and operating costs, increased machine life and tyre life, and lower fuel consumption.

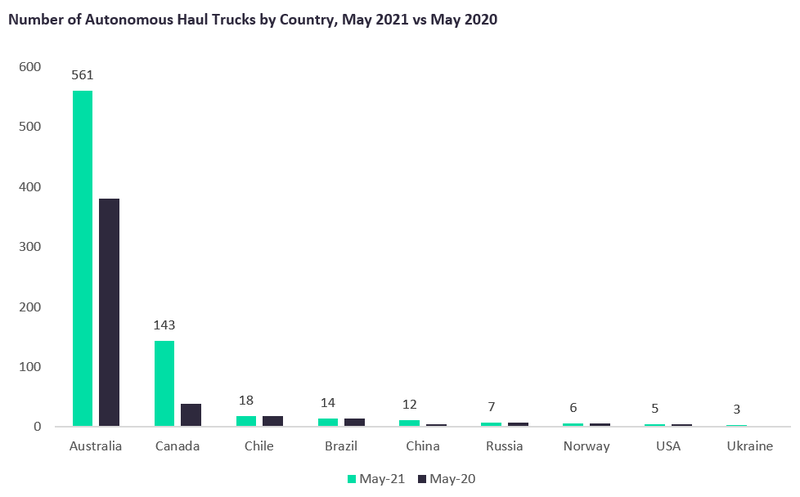

As of May 2021, GlobaData’s Mining Intelligence Center was tracking 769 autonomous haul trucks operating on surface mines across the globe. This compares to 476 at the same point in 2020, an increase of 61%.

The largest collection of autonomous trucks is in Australia with 561, up from 381 a year earlier, followed by Canada (143), Chile (18), and Brazil (14).

Credit: GlobalData

Rio Tinto has the largest number of autonomous trucks in operation, with 184, followed by Fortescue Metals Group, with 179 trucks. BHP has 175 trucks running autonomously or autonomous-ready and Suncor Energy has 76.

Amongst the major developments underway are BHP’s acquisition of an autonomous fleet of up to 86 Komatsu trucks at the Goonyella Riverside coal mine by 2022, and the deployment of 41 new model Komatsu 930E-5 ultra- class haul trucks at the company’s newly-commenced South Flank iron ore mine. BHP is also implementing a transition to a fully autonomous fleet of 34 trucks at the Daunia Mine.

Meanwhile at Newmont’s Boddington mine, the first of 36 planned autonomous units became operational in April 2021. Also in Australia, Caterpillar is supplying a fleet of 20 autonomous 793F trucks for Rio Tinto’s Gudai-Darri iron ore operation. First production is expected by the end of 2021.

In Canada, Suncor Energy and Komatsu reached an agreement in 2018 to add 150 Komatsu autonomous trucks over a six-year period at its oil sands mines. At its Steepbank mine and Fort Hills mine, 29 units and 47 units respectively are already working autonomously, and Millennium mine will have around 100 units by 2024.

Meanwhile, Teck Resources has undertaken an autonomous haulage pilot at its Elkview Operations in Canada using Komatsu autonomous trucks and now has over 20 autonomous trucks in operation. By the end of 2021, the mine is expected to make the entire fleet autonomous.

Caterpillar and Komatsu are the two main suppliers of autonomous vehicles, accounting for over 87% of the trucks tracked by the Mining Intelligence Center, with the 793F and 930E the most popular models for the two OEMs respectively.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Image: Democratic presidential nominee Joe Biden participates in the first presidential campaign debate with US President Donald Trump in Cleveland, Ohio on 29 September 2020. Credit: Alex Gakos / Shutterstock.com

Market Insight from