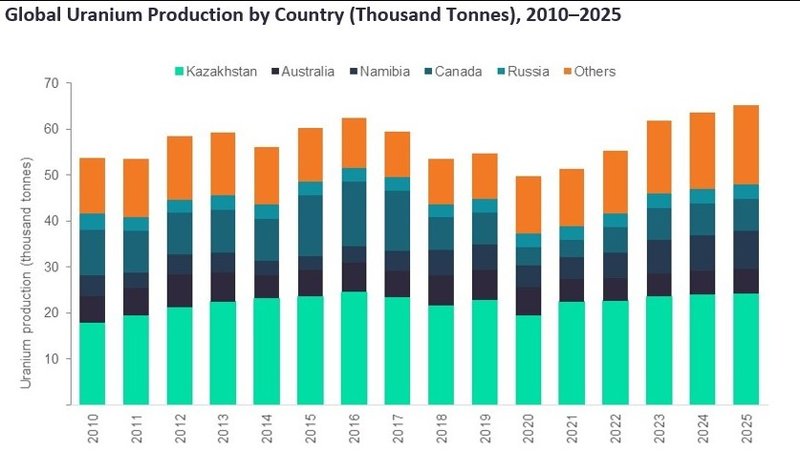

Global uranium production to recover by 3.1% in 2021 after limited growth and Covid-19

Global uranium production is expected to recover by 3.1%, to reach 51.2kt, in 2021, thanks to the return of Cigar Lake in Canada and production from other mines suspended during 2020. Output growth from Kazakhstan (+15.5%) and Russia (+5.2%) will contribute significantly to the overall growth. By contrast, production will continue to decline in Australia (-21.2%), owing to the closure of the Ranger mine.

Global production has been limited in recent years, mainly due to a sluggish uranium market, which was further impacted by the Covid-19 pandemic. In 2020, global production of uranium fell by 9.2% to 49.7kt. The most significant declines were observed in Canada (-43.9%) and Kazakhstan (-14.6%). Globally, almost 60% of uranium originates from these two countries.

In March 2020, Canada’s Cigar Lake mine, which accounts for 12%-13% of global production, was suspended to contain the Covid-19 outbreak, with the suspension in place until September 2020. It then later suspended operations again in mid-December 2020 because of the increasing risks posed by the pandemic, before reopening the mine in April 2021.

In April 2020, Kazakhstan also reduced activities for nearly four months at all uranium mines across the country. The pandemic also led to restrictions in other countries, including Australia, Namibia, and South Africa. Gradually, however, towards the end of the third quarter, restrictions began to ease, with several companies resuming production activities.

Credit: GlobalData

Global uranium production over the forecast period (2021-2025) is expected to grow at a CAGR of 6.2% to reach 65.2kt in 2025. Kazakhstan, which holds some of the world’s largest uranium deposits, is expected to remain the world’s largest supplier for the next few years.

With potential open-pit uranium mines, Namibia is also expected to remain a prominent supplier of uranium to the global markets. Furthermore, the restart of Cigar Lake in April 2021 is expected to provide a much-needed boost to Canada’s uranium supply.

The impact of Covid-19 on the global nuclear industry was relatively minimal because of an early implementation of safety measures, thereby ensuring operations continued with minimal disruption.

These actions enabled companies to effectively manage their workforce and the resources required to keep operations running, even when strict social restrictions were in place. The refuelling of reactors normally takes place every 12 to 18 months, unlike conventional fossil fuel plants that require constant supply.

Meanwhile, planned outages and expansion work at many reactors were delayed during early 2020 and companies instead focused on electricity generation, anticipating higher demand later in 2020.

There has been recent optimism surrounding the global nuclear industry, with several governments incorporating nuclear energy within their plans for reaching climate goals.

For instance, the US, the world’s largest producer of nuclear power, is currently evaluating extending the operating life of its nuclear power plants for up to 100 years. The plants were initially licensed for up to 40 years, but this would permit renewals for up to 20 years with every renewal application.

Others such as China, Japan, South Korea, and the EU upgraded their climate change policies during 2020, indicating higher demand for nuclear power going forward, alongside higher electricity generated from sources other than coal.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Image: Democratic presidential nominee Joe Biden participates in the first presidential campaign debate with US President Donald Trump in Cleveland, Ohio on 29 September 2020. Credit: Alex Gakos / Shutterstock.com

Market Insight from