Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 June

After months of decline, GDP estimates for many countries have turned positive.

Polls show that concern over the spread of Covid-19 is declining, while business optimism remains volatile.

2.3%

The UK’s real GDP grew by 2.3% in April 2021, the fastest since July 2020, with the service sector growing by 3.4% during the month, as per ONS estimates.

0.8%

According to the OECD, real GDP in the G20 area grew by 0.8% in Q1 2021 when compared to the last quarter and reached pre-pandemic levels.

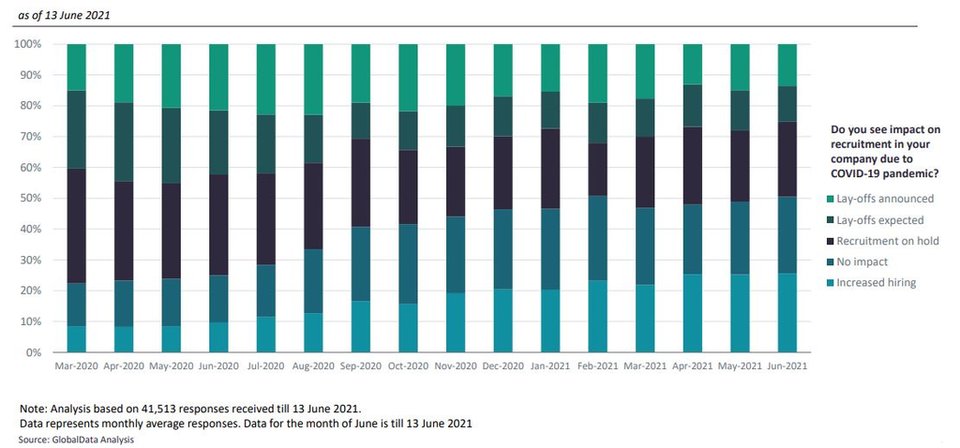

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 7 July

COAL

ICE coal futures prices rose over the course of June, reaching $99/t by the end of the month, compared with $76/t at the start of February. Demand was helped by rising demand from China and other parts of North Asia, as well as supply constraints. China's aversion to buying coal from Australia is also leading to high price increases for lower-quality coal from markets such as Indonesia.

PRECIOUS METALS

After passing $1,900/oz in late May, the gold price dropped to $1,764/oz in June, averaging $1,836/oz for the month. An improving economic outlook had dampened prospects for a rise in the gold price, although they are being supported by continued low interest rates in 2021 and rising US inflation.

BASE METALS

With rising inventories, the average copper price in June was down by 5.6% on May. There was also speculation that China may release more of its stockpiles of copper to temper the rise in the copper price. Concerns over supplies from Chile, where production declined YoY in Q1, plus a threat of strikes and also higher mining taxes, may push prices high over the remainder of 2021.

IRON ORE

Iron ore prices passed $200/t at the start of June as requirements for production cuts at Chinese mills were eased, and remained above that level during the whole of June. China is aiming to reduce its carbon footprint, with reduced steel output in 2021 to support this. However, to date steel production has improved with output of 97.9mt in April 2021, a YoY increase of 13.4%.

PALLADIUM & PLATINUM

After reaching a six-year high of $1,325/troy oz in February, the price of platinum stabilised from March to May before dropping over June to its lowest point since January. In 2021, prices will be supported by improved demand from the auto and industrial sectors, although this will be balanced by significant growth in supply after the 2020 challenges.