Private players to drive India’s coal output despite Covid-19 and renewables

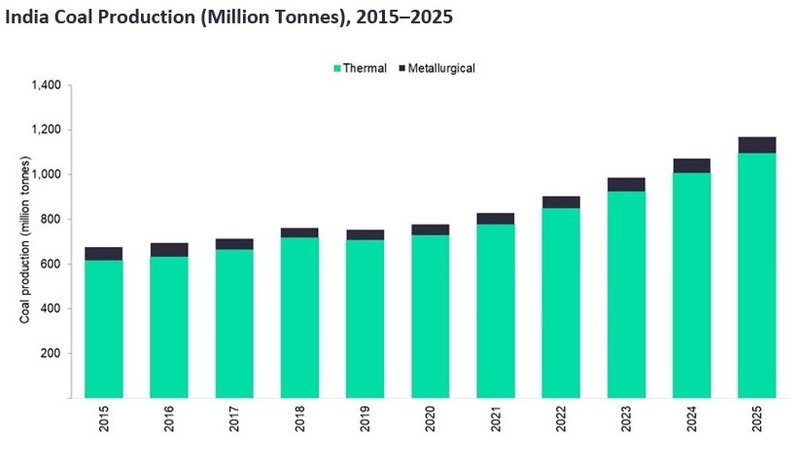

Coal production in India is expected to grow from 777Mt in 2020 to 827.8Mt in 2021, a 6.4% increase. This follows a growth of 3.1% in 2020, despite the operational disruptions caused by the Covid-19 pandemic.

Key to the increase in output will be the entry of private players in the Indian coal industry. Since August 2019, the government has looked to encourage greater domestic production and reduce dependency on imports by permitting 100% foreign direct investment in coal mining.

It has also incentivised the auction process by offering to reduce the government’s share of revenues by 20% if the company begins production two years early and a 10% reduction when companies start production one year prior. After successfully auctioning 19 coal blocks in November 2020, the government listed 75 coal blocks to be auctioned in the second phase, of which 68 are thermal coal mines.

Credit: GlobalData

Overall, the government is targeting production of one billion tonnes of coal by FY2023-24 to help reduce its dependence on imports and GlobalData expects India’s coal production to grow at a CAGR of 9% to reach 1.2 billion in 2025.

Covid-19 will present some short-term challenges to this. There has been a sharp increase in new Covid-19 cases since the beginning of March 2021, leading to a series of fresh lockdowns across key coal-producing states such as Odisha, Chhattisgarh, Madhya Pradesh, Maharashtra, and Telangana.

Coal India’s operations have also been hampered during the second wave as employees tested positive. Despite this, a slight recovery in coal offtake was observed in April 2021, indicating a revival in demand over the coming months.

In the longer term, whilst power demand is growing, coal is gradually declining as a proportion of the power generated. In 2020, around 73% of the electricity in India was generated from coal.

However, India has environmental commitments to reduce carbon emissions to 50% by 2030. As a result, the share of coal-fired electricity generation is forecast to fall to 70.6%, while the share of renewables rises from 2.9% in 2020 to 4.2% in 2025.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Image: Democratic presidential nominee Joe Biden participates in the first presidential campaign debate with US President Donald Trump in Cleveland, Ohio on 29 September 2020. Credit: Alex Gakos / Shutterstock.com

Market Insight from